Developed by Davit Zhorzholiani (d.zhorzholiani@iset.ge) under guidance of Robert Tchaidze (robert@jhu.edu).

The goal of the Budget Execution Monitor (BEM) is to forecast the revenues and expenditures of the general government of Georgia for the current year, using past seasonal patterns and actual data observed so far for the current year. The BEM will be published twice a year: in May, making use of data from the first quarter, and in October, making use of data from the first three quarters. We rely on data provided by the Ministry of Finance of Georgia (MOF), but also make use of data provided in the reports of the International Monetary Fund (IMF).

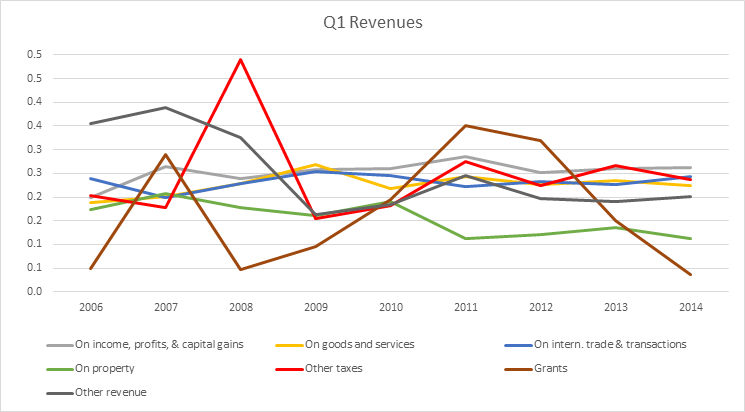

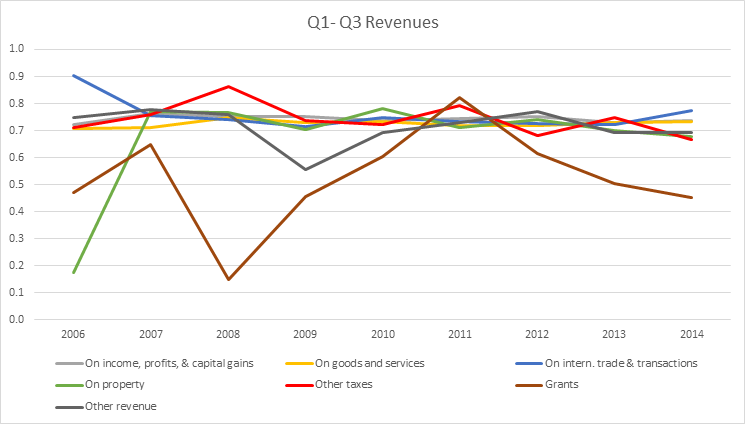

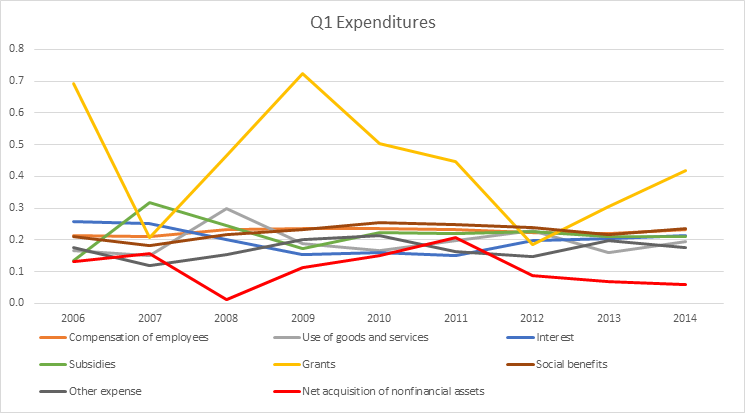

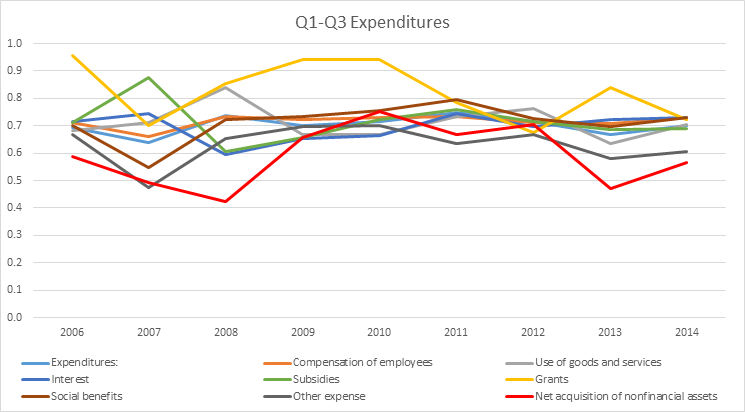

The BEM forecasts seven different revenue categories (taxes on income, profits and capital gains; taxes on property; taxes on goods and services; taxes on international trade and transactions; other taxes; grants; and other revenue) and eight different expenditure categories (compensation of employees; use of goods and services; interest; subsidies; grants; social benefits; other expenses; and net acquisition of nonfinancial assets).

The forecasts are based on past seasonal patterns. We look at the shares of revenues and expenditures recorded for the year as a whole that take place in the first quarter (for the May report) and in the first three quarters (for the October report). The average of these shares is the basis for our forecasts. For those revenue and expenditure categories where seasonal shares are stable over time, we use 2004-2014 data. However, there are several categories that have exhibited high volatility and have only recently stabilized. In those cases, we only use 2011-2014 data.1

The overall balance forecast is the difference between the sum of all revenue categories and the sum of all expenditure categories. We also report the operational balance, which excludes capital spending (or “net acquisition of nonfinancial assets”) from expenditures.

After constructing our forecasts, we compare them with the latest IMF forecast and a forecast based on the budget law for revenues and the MoF’s ‘Basic Data and Directions’ publication for expenditures.

1 The categories based on 2004-2011 data are: taxes on international trade & transactions; taxes on property; compensation of employees; use of goods and services; grants (expenditure); other expenses; and net acquisition of nonfinancial assets. The categories based on 2011-2014 data are: taxes on income, profits & capital gains; taxes on goods and services; other taxes; other revenue; subsidies; and social benefits. Grants (revenues) and interest expenditures are not forecasted; instead the MOF’s data are used.