ISET-PI has begun publication of a new product – the Budget Execution Monitor (BEM).

The goal of the BEM is to forecast revenues and expenditures of the general government of Georgia for the current year, using past seasonal patterns and actual data observed so far in the year.

The BEM will be published twice a year – once after the first quarter data is available, and later when the data for the first three quarters becomes available. We rely on data provided by the Ministry of Finance of Georgia (MOF) and the International Monetary Fund (IMF). The BEM methodology is outlined on the project’s website.

BEM forecast highlights:

- For the 2015 budget, the BEM predicts a deficit in the overall balance [1] and a surplus in the operational balance [2] of the general government budget. The overall balance deficit is projected to be 450 mln GEL, which is nearly 1.5 times higher than the 181 mln GEL deficit forecast by the MOF at the beginning of the year, but 54% lower than the 970 mln GEL deficit projected by the IMF.

- Higher projected tax revenues. In 2015, BEM-projected revenues are 210 mln GEL (2.4 %) higher than the MOF’s forecast and 205 mln GEL (2.3 %) higher than the IMF’s forecast.

- The top contributors to the revenue collection process are taxes on income, profit and capital gains. The worst performer so far are taxes on international trade and transactions (forecast to be 40% lower than the MOF’s projections).

- Higher projected expenditures. In 2015, projected expenditures are 479 mln GEL higher than the MOF’s forecast (5.4%) and 315 mln GEL (3.2 %) less than the IMF’s forecast.

- Expenditures are mainly driven by the “other expenditures” category, which is forecast to exceed the MOF’s target by 61%. This category includes expenditures connected to property (except interest) and other current and capital expenditures, such as transfers to households in kind or in monetary form.

Table #1. Predicted budget revenues and expenditures for 2015, mln. GEL

| MoF | IMF | ISET-PI | |

| REVENUES | 8,765 | 8,770 | 8,975 |

| Taxes on income, profits and capital gains | 3,142 | 3,142 | 3,311 |

| On goods and services | 4,476 | 4,515 | 4,430 |

| On international trade andtransactions | 114 | 115 | 68 |

| On property | 273 |

258 |

274 |

| Other taxes | 25 | 25 | |

| Other revenue | 520 | 530 | 653 |

| Grants | 215 | 210 | 215 |

| EXPENDITURES | 8,946 | 9,740 | 9,425 |

| Compensation of employees | 1,580 | 1,610 | 1,633 |

| Goods and services | 1,120 | 1,200 | 1,160 |

| Subsidies and grants | 754 | 597 | 742 |

| Social expenses | 2,945 | 2,923 | 3,023 |

| Other | 832 | 1,055 | 1,337 |

| Interest | 375 | 340 | 375 |

| Capital spending | 1,340 | 2,015 | 1,156 |

| OVERALL BALANCE | -181 | -970 | -449 |

| Operational balance | 1,159 | 1,045 | 706 |

Highlightsofthe revenue and expenditure categories of the government budget:

- Revenues are set to exceed the government’s projections from the beginning of the year. The top contributors to this increase (in absolute terms) will be taxes on income, profit and capital gains. The worst performer this year will be taxes on international trade and transactions (40%lower than the MOF’s projections).

- Expenditures are also set to increase – mainly driven by the “other expenditures” category, which is set to exceed the MOF’s target by 61%. In this category, we include expenditures connected to property (except interest) andother current and capital expenditures, such as transfers to households in kind or in monetary form.

Revenues

The forecasts for six of the sevenrevenue categories are optimistic. Taxes on propertyandother taxesareboth expected to hit the targets set by the MOF within one millionGELaccuracy. However, the forecast for thetaxes on international trade and transactionscategory is lowerthan the MOF’s projections by46mlnGEL and it is expected to be the worst performer of the budget, realizing only approximately 59% of the MOF’s plan.The dynamics of the direct taxes collected are most promising in absolute terms. The projections for taxes on income, profit and capital gainsare expected to generate 169 mlnGEL (5%) more revenues than the MOF initially planned.On the other hand, the best performer of the budget inrelative terms is expected to be the other revenuecategory, whichpromises to generate 26%(133 mlnGEL) more income than the fiscal authority of Georgia hoped.The projection for thegrantscategory in the BEM is set according to the MOF’s plan. The BEM forecasts that overall revenues willexceed the MOF’s plan by 2.4%.

Expenditures

The forecasts for the expenditure categories are mixed. Four out of the eight expenditure categories are expected to overshoot the targets, while threeare expected to do the opposite. Overspending is expected to be within3% of the initial MOF targets for three categories, while for the other expenditures category greaterovershooting is expected in both absolute and relative terms (505 mln GEL and 61% above the target). On the other hand, subsidiesare expected to be marginally less than the target and the net acquisition on nonfinancial assetsis expected to be just 86% of the initially planned amount, thus decreasing the expected overall expenditure by about 184 mlnGEL.Overall, the BEM predicts 5.3% higher total expenditures forthe budget than the MOFhas predicted.

Balance

Compared to the MOF’s projections, the BEM is more pessimistic about the both the operationalandoverall balanceof the budget. Theforecasted overshootingof the budget revenue target is dominated by the projected increase on the expenditures’ side. According to the BEM, the surplus of the operational balanceis expected to be453 mlnGELlower (39% belowthe MOF’s predictions), while the deficit of the overall balanceis expected tobe 269mlnGELhigher(148% higher than the MOF’spredictions).

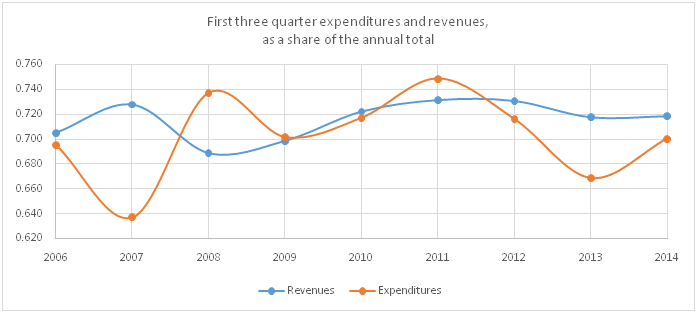

Historical data and dynamics

[1] The overall balance is the difference between all revenue and all expenditure categories, including the net acquisition of nonfinancial assets. Examples of nonfinancial assets acquired by the government include any type of physical capital, such as machinery, land, real estate, etc.

[2] The operational balance is the difference between all revenue and all expenditure categories, except the >net acquisition of nonfinancial assets (such as land, buildings, machinery, etc.).