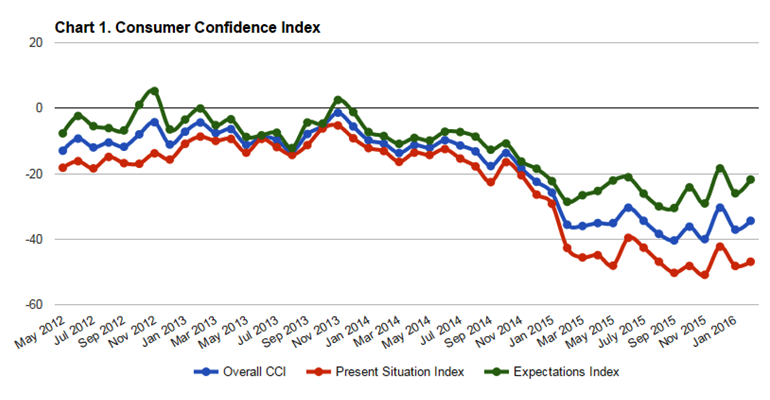

The customer confidence index rebounded in February 2016 after a sharp fall in January. The government’s more active involvement in the regions, primarily through agricultural programs, seem to have borne fruit. The two most notable of such programs are “Plant the Future”, which provides subsidies for farmers willing to invest in orchards, and the subsidies offered to farmers for plowing. Although the CCI for Tbilisi continued to decrease in February, Georgia’s regions drove the overall improvement in the country-wide index.

In February, the consumer confidence index reached -34.4 points (a 2.7 point increase from January 2016). The present situation component of the index slightly increased by 1.2 points, reaching the -46.9 point mark. In contrast, the expectations index increased more significantly by 4.2 points, reaching the -21.8 point mark.

Responses to different survey questions show some of the reasons behind the CCI’s increase in February. Although the answers to most questions did not change, notable improvements were seen in the assessments of past and expected inflation levels, and of expected unemployment levels. In contrast, the outlook regarding savings worsened, with respondents expecting to save less in the upcoming 12 months.

To summarize the general CCI findings:

- The share of respondents who said that prices rose a lot over the past 12 months decreased from 72% to 65% in February.

- The share of respondents who expected prices to grow over the next 12 months decreased from 63% to 51% month over month (MoM).

- The share of respondents who expected unemployment to fall in the next 12 months increased from 19% to 26% in February.

- The share of respondents who did not expect to save over the next 12 months increased from 89% to 95% MoM.

These results might be reflective of the impact of the preparations for the upcoming planting season in the regions. They may also signal that the government’s proposed agricultural programs are creating hope for better economic conditions in the future.

The table below summarizes the monthly consumer confidence index changes across the different age, gender and education strata:

| Sub-Group | Present Situatuation | Expectations | Overal CCI |

| AGE | |||

| 35 and below | -46 (up by 3 points) | -19 (up by 4 points) | -32 (up by 1 point) |

| Over 35 | -48 (up by 4 points) | -25 (up by 4 points) | -36 (up by 4 points) |

| GENDER | |||

| Male | -40 (up by 5 points) | -17 (up by 8 points) | -28 (up by 7 points) |

| Female | -52 (down by 2 points) | - 26 (up by 1 point) | -39 (down by 0.3 points) |

| EDUCATION | |||

| Higher education | -39 (up by 4 points) | - 18 (up by 6 points) | - 29 (up by 5 points) |

| The rest | -54 (down by 1 point) | -25 (up by 3 points) | - 39 ( up by 1 point) |

REGIONAL PECULIARITIES

The overall consumer confidence index for Tbilisi and the rest of Georgia (RoG) moved in opposite directions in February. The upward swing in the regions was much more pronounced than the decline observed in the capital. The overall index slightly decreased in Tbilisi (by 1.1 points) reaching the -35 point mark. In contrast, the CCI increased significantly in the RoG (by 5.1 points) reaching -34 points.

| Tbilisi | Rest of Georgia (RoG) | |

| Overall CCI | -35 (down by 1 points) | -34 (up by 5 points) |

| Present Situation Index | -47 (down by 4 points) | -47 (up by 5 points) |

| Expectations Index | -23 (down by 2 points) | -21 (up by 6 points) |

| Expectations-Present Gap | 24 points | 26 points |

In Tbilisi, the worsening of the index was mainly seen in the responses to the survey questions related to the ability to make major purchases, the ability to save, and the present situation of households. In contrast, fewer respondents from Tbilisi expected an increase in prices.

To summarize the changes in consumer confidence in Tbilisi:

- The share of respondents stating that it was a good time to make major purchases decreased from 27% to 19% in February.

- The share of respondents stating that it was a very bad moment to save increased from 58% to 65% MoM.

- The share of respondents reporting that they are incurring debt increased from 50% to 59% in February.

- The share of respondents expecting to spend less on major purchases increased from 68% to 75% MoM.

- The share of respondents not expecting to save in the upcoming 12 months increased from 88% to 99% in February.

- The share of the respondents expecting prices to grow over the next 12 months decreased from 69% to 49% MoM.

Responses from the rest of Georgia (RoG) in February were much more optimistic and more in line with the overall CCI pattern. Compared to January’s data, fewer people in the regions saw large price increases in the past 12 months, and a smaller number of respondents said that they were incurring debt. From the expectations perspective, a smaller share of respondents expected unemployment and prices to increase in the future.

To summarize the CCI responses from the rest of Georgia:

- The share of respondents stating that prices rose a lot over the past 12 months decreased from 75% to 66% in February.

- The share of respondents stating that they are incurring debts decreased from 60% to 53% MoM.

- The share of respondents expecting prices to increase over the next 12 months decreased from 59% to 52% MoM.

- The share of respondents expecting unemployment to fall increased from 19% to 28% in February.