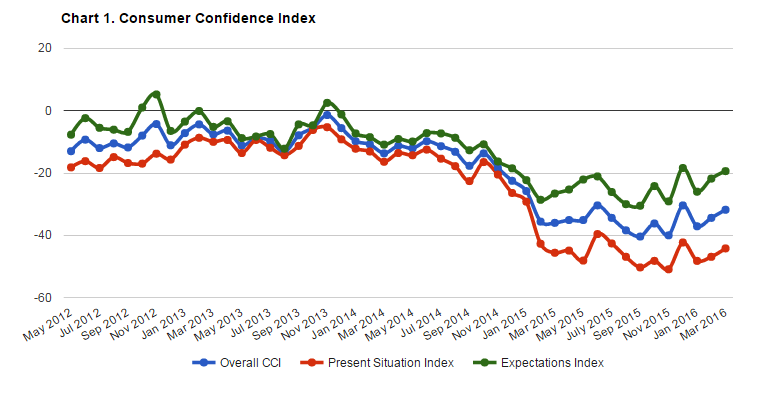

In March 2016, the consumer confidence index (CCI) continued the increasing trend that started in October 2015. The index gained 8.6 points compared to the historic low of September 2015. Although an upward trend is clearly visible, the current CCI is still some 30.4 points adrift of the highest point seen in November 2013. Some of the factors behind the increase in March were the appreciation of the lari against the U.S. dollar, a decrease in food prices and a good winter tourism season. Interestingly, the largest improvement of the CCI was observed for respondents aged below 35, signaling that recent proactive government measures to improve the business climate may have influenced people’s perceptions.

In March, the consumer confidence index reached -31.8 points (gaining 2.5 points from February 2016). The present situation index increased by 2.7 points, reaching the -44.2-point mark. Similarly, the expectations index gained 2.4 points, reaching the -19.4-point mark.

Although the answers to most questions did not change significantly since February, there were some noticeable improvements in the assessment of the general economic situation, time to save and inflation expectations.

To summarize the general CCI findings:

- The share of respondents who said that the general economic situation had worsened a lot over the last 12 months decreased from 43% to 36% in March.

- The share of respondents who thought that it was is a very bad moment to save decreased from 65% to 58% month over month (MoM).

- The share of respondents expecting prices to stay about the same increased from 25% to 36% in March.

These results might be reflective of the improving economic environment in March 2016. In particular, after a long period of devaluation, the Georgian lari appreciated against the US dollar by almost 4%. Inflation also slowed down to 4.1%, with food prices being a major contributor to the fall. Meanwhile, data on international visitors in the first quarter showed a 15% increase in annual terms.

The table below summarizes the monthly consumer confidence index changes across the different age, gender and education strata:

| Sub-Group | Present Situatuation | Expectations | Overal CCI |

| AGE | |||

| 35 and below | -37.9 (up by 8 points) | -12.6 (up by 6 points) | -25.2 (up by 7 points) |

| Over 35 | -48.5 (up by 1 points) | -24.1 (up by 0.4 points) | -36.3 (down by 0.2 points) |

| GENDER | |||

| Male | -37.7 (up by 2 points) | -15.7 (up by 1 point) | -26.7 (up by 1 points) |

| Female | -50.8 (up by 2 points) | -23.2 (up by 2 points) | -37 (up by 0.4 points) |

| EDUCATION | |||

| Higher education | -39.1 (a point change) | -17.4 (up by 0.8 points) | -28.3 (up by 0.4 points) |

| The rest | -48.7 (down by 5 point) | -21.1 (up by 4 points) | - 34.9 ( up by 4 points) |

SPRING BLOSSOMS FOR THE YOUNG

Observing the CCI for different respondent groups shows that the largest change was for younger respondents aged 35 or below, who represent 40% of the sample. In contrast, the index did not change substantially for older respondents. Recent government actions to improve the business climate in the country have mainly benefited the younger respondents of the survey.

Answers to different survey questions provide some insight into the current pattern of the CCI for different age groups. Improvements in the answers regarding personal financial situations, the general economic situation in the country, inflation, and time to make major purchases and save were the primary drivers of the CCI increase for younger respondents:

- The share of younger respondents saying that the financial situation of their household worsened a lot over the past 12 months decreased from 33% to 24% in March.

- The share of younger respondents saying that the general economic situation got a lot worse over the last 12 months decreased from 51% to 38% MoM.

- The share of younger respondents expecting the general economic situation in the next 12 months to get better increased from 40% to 47% in March.

- The share of younger respondents expecting prices to grow decreased from 53% to 41% month over month.

- The share of younger respondents saying that it was a good time to make major purchases increased from 27% to 34% in March.

- The share of younger respondents saying that it was a bad moment to save decreased from 60% to 50% MoM.

Older respondents (above 35) had a similar pattern in terms of inflation expectations, but this age group was more concerned with expected unemployment and the fact that it was not a good moment to make major purchases:

- The share of older respondents expecting prices to grow decreased from 49% to 39% MoM.

- The share of older respondents expecting unemployment to fall decreased from 30% to 16% in March.

- The share of older respondents saying that it was not a good moment to make major purchases increased from 42% to 50% MoM.

REGIONAL PECULIARITIES

The overall consumer confidence index in March increased in a similar way in Tbilisi and the rest of Georgia (RoG). The overall index increased by 2.1 points in Tbilisi, reaching -33 points. As for the RoG, the CCI increased by 2.8 points, reaching -31 points.

| Tbilisi | Rest of Georgia (RoG) | |

| Overall CCI | -33 (up by 2 points) | -31 (up by 3 points) |

| Present Situation Index | -45 (up by 2 points) | -44 (up by 3 points) |

| Expectations Index | -21 (up by 2 points) | -18 (up by 3 points) |

| Expectations-Present Gap | 24 points | 25 points |

In Tbilisi, the improvement in consumer confidence was driven by assessments of expected inflation, and the timing of saving and making major purchases. Past inflation was a factor pushing the CCI down.

To summarize the changes in consumer confidence in Tbilisi:

- The share of respondents from Tbilisi saying that prices had risen moderately increased from 15% to 24% in March.

- The share of respondents from Tbilisi expecting prices to grow decreased from 49% to 40% MoM.

- The share of respondents from Tbilisi saying that it was a good time to make major purchases increased from 19% to 25% in March.

- The share of respondents saying that it was a very bad moment to save decreased from 65% to 52% month over month.

Responses from the rest of Georgia (RoG) had a slightly different pattern. Improvements were seen in responses to questions related to the assessment of general economic situation, expectations about inflation and making major purchases.

To summarize the CCI responses from the rest of Georgia:

- The share of respondents from the RoG assessing the general economic situation as a lot worse decreased from 45% to 34% in March.

- The share of respondents from the RoG expecting prices to grow over the next 12 months decreased from 52% to 40% MoM.

- The share of respondents expecting to spend less over the next 12 months decreased from 22% to 15% month over month.