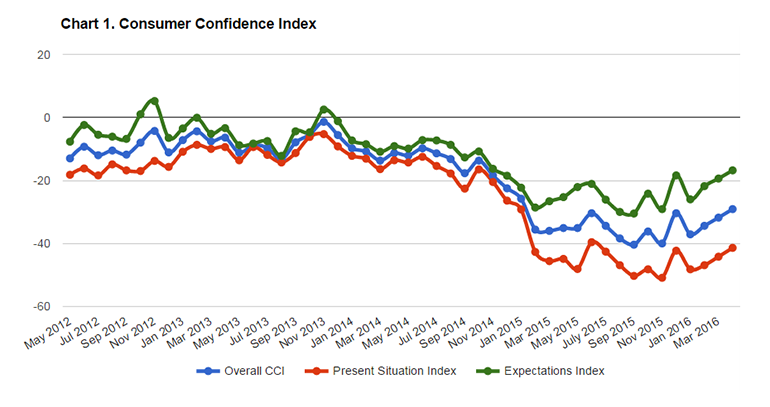

In April 2016, the consumer confidence index (CCI) continued to increase, sustaining the trend which started in January. From an economic perspective, the lari’s appreciation (from 2.32 to 2.23 GEL/USD) was one of the most important visible developments in April. Furthermore, with Easter celebrations underway, many stores offered discounts on a variety of consumer items. This helped position April as a good time for major purchases in the minds of consumers. Lastly, the pre-election period has started, affecting the expectations component of the index.

In April, the overall consumer confidence index reached -29.1 points (gaining 2.7 points from March 2016). Both the present situation and expectations indices increased. The present situation index increased by 2.8 points, reaching the -41.4-point mark. Likewise, the expectations index gained 2.6 points, reaching the -16.8-point mark.

The good news is that since February 2016 the monthly increase of the index has been accompanied with year-on-year improvements. This development implies that consumer confidence in Georgia is finally climbing out of the “pit” in which it was stuck for nearly a year.

Interestingly, in April 2016 the year-on-year increase in CCI was the largest in the history of the survey. The overall index gained 6 points compared to the same period last year. Both the present situation and expectations indices increased, by 3.5 and 8.5 points respectively.

Although we see an improvement in consumer confidence, the answers to the survey questions did not change very significantly. The largest positive changes were observed in answers related to the timing of making major purchases and savings. Some negative changes were observed in answers to questions about the current financial situation of households.

The combined effect of these changes drove the improvement in the overall CCI.

To summarize the general CCI findings:

- The share of respondents who said that the financial situation of their household had got a lot worse increased from 30% to 35% in April.

- The share of respondents saying that it was not a good moment to make major purchases decreased from 41% to 34% month over month (MoM).

- The share of respondents saying that it was a very good moment to save increased from 8% to 14% in April.

The overall responses to other questions changed very modestly, despite the fact that the sharp appreciation of GEL, the further decrease in inflation to 3.1% and the Easter festivities each had the potential to push the index up even further. The table below summarizes the monthly consumer confidence index changes across the different age, gender and education strata. Interestingly, in April men turned out to be more pessimistic than women in assessing the present, as well as the future economic situation.

| Sub-Group | Present Situatuation | Expectations | Overal CCI |

| AGE | |||

| 35 and below | -37.8 (no change) | -9.4 (up by 3 points) | -23.6 (up by 2 points) |

| Over 35 | -43.8 (up by 5 points) | -21.8 (up by 2 points) | -32.8 (up by 4 points) |

| GENDER | |||

| Male | -40.7 (down by 3 points) | -19.4 (down by 4 points) | -30.1 (down by 3 points) |

| Female | -41.9 (up by 9 points) | -14.9 (up by 8 points) | -28.4 (up by 9 points) |

| EDUCATION | |||

| Higher education | -34.9 (up by 4 points) | -15.7 (up by 2 points) | -25.3 (up by 3 points) |

| The rest | -47.2 (up by 2 points) | -17.8 (up by 3 points) | -32.5 (up by 4 points) |

REGIONAL PECULIARITIES

The overall consumer confidence index in April increased in both Tbilisi and the rest of Georgia (RoG). The overall index increased by 4.3 points in Tbilisi, reaching the -28.7-point mark. As for the RoG, the CCI increased more modestly, by 1.8 points, reaching -29.3 points.

| Tbilisi | Rest of Georgia (RoG) | |

| Overall CCI | -33 (up by 2 points) | -31 (up by 3 points) |

| Present Situation Index | -45 (up by 2 points) | -44 (up by 3 points) |

| Expectations Index | -21 (up by 2 points) | -18 (up by 3 points) |

| Expectations-Present Gap | 24 points | 25 points |

In Tbilisi, the change in responses to various questions was very modest. The increase in Tbilisi was mainly driven by consumers’ perceptions about the timing of major purchases and saving. In contrast, the responses about the financial situation of households and the assessment of the general economic situation pushed the index down.

To summarize the changes in consumer confidence in Tbilisi:

- The share of respondents from Tbilisi saying that it was not a good time to make major purchases decreased from 38% to 28% in April.

- The share of respondents from Tbilisi saying that it was a very good moment to save increased from 9% to 15% MoM.

- The share of respondents from Tbilisi saying that the financial situation of their household got a lot worse increased from 28% to 35% in April.

- The share of respondents from Tbilisi saying that the general economic situation in the country got worse increased from 53% to 58 month over month.

The modest increase of the CCI in the rest of Georgia (RoG) was driven by consumers’ assessments of the general economic situation and the timing of major purchases. Like in Tbilisi, the survey question about the general economic situation over the last 12 months drove April’s CCI down for the RoG. At the same time, the question about the timing of major purchases supported an increase of the index.

To summarize the CCI responses from the rest of Georgia:

- The share of respondents saying that the general economic situation got a lot worse over the last 12 months increased from 34% to 42% in April.

- The share of respondents saying that it was not a good time to make major purchases decreased from 44% to 37% MoM.

Despite the conflicting answers to some questions, it is clear that the CCI has been recovering across the board, both in Tbilisi and in the regions. These developments give hope for balanced and sustained recovery in the future.