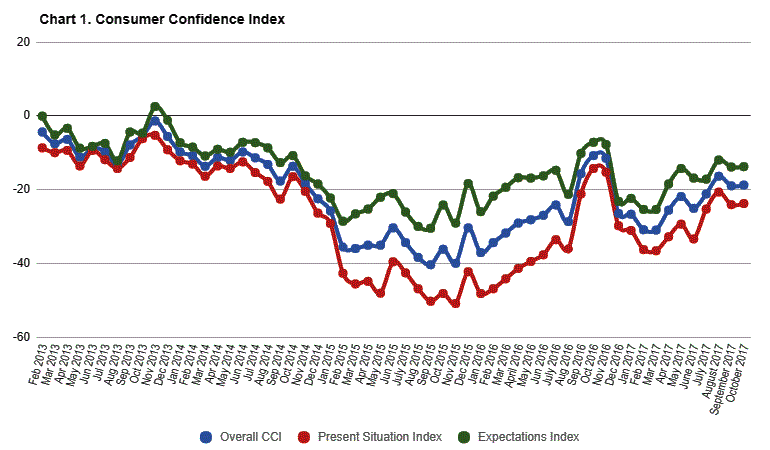

According to a nationally representative sample of 367 individuals undertaken in early October 2017, ISET’s Consumer Confidence Index (CCI) added only 0.2 points, rising from -19 in September to -18.8 points in October. A similarly miniscule change was observed in both sub-indices: the Present Situation Index improved by 0.3 (from -24.1 to -23.8), and the Expectations Index by 0.1 index points (from -13.9 to -13.8), compared to September.

However, the change in CCI is neither small nor positive when compared to its last year level. The Index lost 8 points (from -10.8 to -18.8) in yearly terms. In line with a well-established trend in global consumer confidence research, last year’s parliamentary elections, held in October 2016, provided a major boost to consumer confidence in the three months just prior to and immediately following the voting day. Given the lesser significance of Georgia’s municipal elections held this year, no similar pattern was observed in either September nor October 2017.

HAPPINESS EVERYWHERE?

While September saw a major gap in consumer confidence emerging between the seemingly happy Tbilisi and the rest-of-Georgia, this trend was reversed in early October (before the beginning of the recent lari devaluation). Tbilisi lost 4.1 index points (from -12.6 to -16.7), whereas rest-of-Georgia gained 4.5 points, going up from -24.8 to -20.3. To at least to some extent, this could be attributed to the beginning of the grape harvest period, Rtveli, which is naturally associated with a sharp increase in the consumption of alcohol in Georgia’s countryside.

THE ASIAN PARTY POOPER…

Unfortunately, the mood is not as festive in Western Georgia, where the entire agricultural sector has been devastated by the infamous stink bug, or “pharosana,” as it is known in Georgia is (see our most recent blog article: “Asian Invasion: Stink Bug in Georgia”). As is demonstrated below, the entire improvement in rest-of-Georgia’s consumer confidence is associated with wine festivities in Kakheti and other eastern regions. October CCI in Georgia’s east saw an almost 11-point improvement in just one month, exceeding its level in Tbilisi. At the same time, Georgia’s west (and, in particular, the predominantly rural areas in Imereti, and the hazelnut-heavy Samegrelo and Guria) continues to lose confidence. After taking a major hit in September, Western Georgia’s CCI lost another point in October, reaching -23.4 index points, well below the levels of CCI observed in Tbilisi and the east, where harvest parties have not been interrupted by any Asian invaders. In fact, according to the National Wine Agency of Georgia, this year’s harvest was better than in 2016. In September alone, almost 126,000 tons of Georgian grapes were processed into wine. Given higher grape prices (affected by stronger demand for Georgian wine in Russia, China and other traditional markets), farmers’ revenues increased by a hefty 49 mln GEL.

MONTHLY AND YEARLY CHANGES IN THE CCI VARIABLES