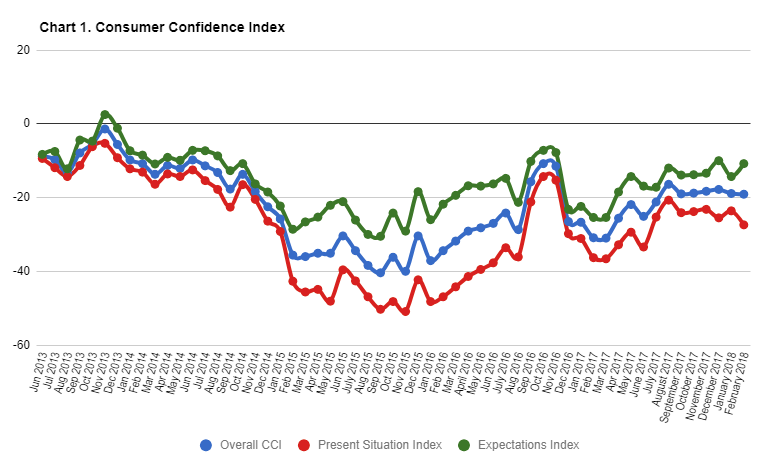

Georgian consumer sentiment remained practically unchanged in February 2018, extending a fairly long trend of stability (or stagnation) that goes back to at least August 2017. The CCI lost a tiny 0.2 index points, declining from -18.9 in January to -19.1 index points in February 2018. CCI’s two sub-indices, capturing consumer expectations and present situation assessment, moved in the opposite directions. The Present Situation Index lost 3.8 (declining from -23.6 to -27.4 index points). Its complement, the Expectations Index, added 3.5 points (rising from -14.3 to -10.8 index points). Georgians seem to remain optimistic even when lacking joy in their day-to-day existence.

EDUCATED CONSUMERS ARE AFFECTED BY INFLATION IN ALCOHOL, CIGARETTES AND FUEL PRICES BUT ARE MUCH MORE LIKELY TO SAVE

Table 1. ANNUAL INFLATION IN “BAD” GOODS THAT ARE SUBJECT

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

| Source: Georgian Statistics Agency |

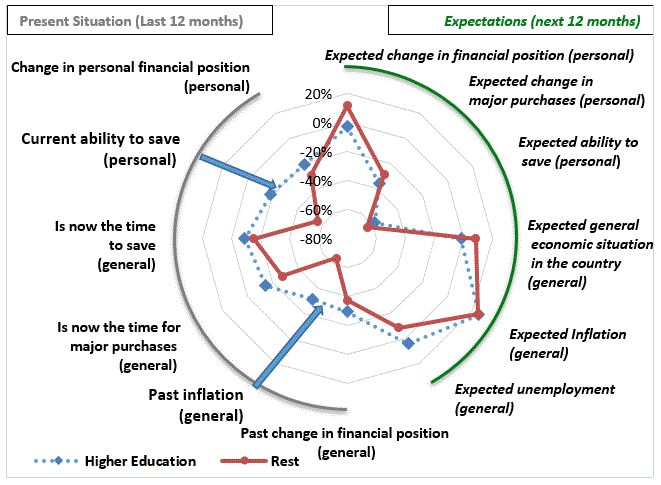

2017 was not an easy year for those Georgian consumers, particularly for the drivers among them, and those who like to indulge in bottled wine and cigarettes. These “bad” goods are subject to excise taxes, which have been significantly raised by the Georgian government in January 2017. Year-on-year increases in the prices of these items ranged from 5-6% (for bottled wine) to 15% (for diesel fuel) to more than 27% (for domestically produced cigarettes). Judging by the CCI data, more educated consumers have been disproportionately hit by these price increases. Is it because rural Georgians are less likely to drive SUVs, drink refined bottled wines or smoke Marlboro cigarettes?

Table 2. THE GAP IN CONSUMER CONFIDENCE (IN INDEX POINTS): PEOPLE WITH HIGHER EDUCATION VS. OTHERS, FEBRUARY 2018

| * Your current ability to save? | 37.5% |

| * How much did consumer prices rise, past 12 months | 32.9% |

| * Is now the right time for people to make major purchases in Georgia? | 13.4% |

| Expected level of unemployment in Georgia, next 12 months | 13.0 |

| * Your financial situation, past 12 months | 8.8% |

| * How did the general economic situation changed in Georgia, past 12 months | 8.1% |

| * Is now the right time for people to save in Georgia? | 6.2% |

| Your ability to save, next 12 months | 6.0% |

| Do you expect prices to increase more rapidly, next 12 months? | 0.7% |

| Do you expect to increase spending on major purchases compared to the past, next 12 months | -7.1% |

| General economic situation, next 12 months | -10.0% |

| How will your financial situation change, next 12 months | -14.3% |

Underlined questions are concerned with the respondent’s personal situation;

(*) denotes questions concerning the past and present situation

As shown in Table 2, the relatively more educated consumers are happier with their present situation, but do not expect their lives to significantly improve in the future. For the less educated, hopes die last…

Also very interesting are gender disbalances in consumer confidence (see Table 3). Women are more oblivious to price increases (because they smoke, drink and drive less?) and, being survival oriented, are convinced that now is the time to start saving and making major purchases.

Table 3. THE GAP IN CONSUMER CONFIDENCE (IN INDEX POINTS): MALES VS. FEMALES, FEBRUARY 2018

|

* How much did consumer prices rise, past 12 months |

13.5% |

| * Your current ability to save? | 5.2% |

| * How did the general economic situation changed in Georgia, past 12 months | 4.4% |

| Expected level of unemployment in Georgia, next 12 months | 3.5% |

| Do you expect prices to increase more rapidly, next 12 months? | 2.8% |

| General economic situation, next 12 months | 1.2% |

| * Your financial situation, past 12 months | -2.5% |

| Your ability to save, next 12 months | -2.7% |

| Do you expect to increase spending on major purchases compared to the past, next 12 months | -2.8% |

| How will your financial situation change, next 12 months | -7.3% |

| * Is now the right time for people to save in Georgia? | -8.3% |

| * Is now the right time for people to make major purchases in Georgia? | -9.4% |

Underlined questions are concerned with the respondent’s personal situation;

(*) denotes questions concerning the past and present situation

MONTHLY AND YEARLY CHANGES IN THE CCI VARIABLES