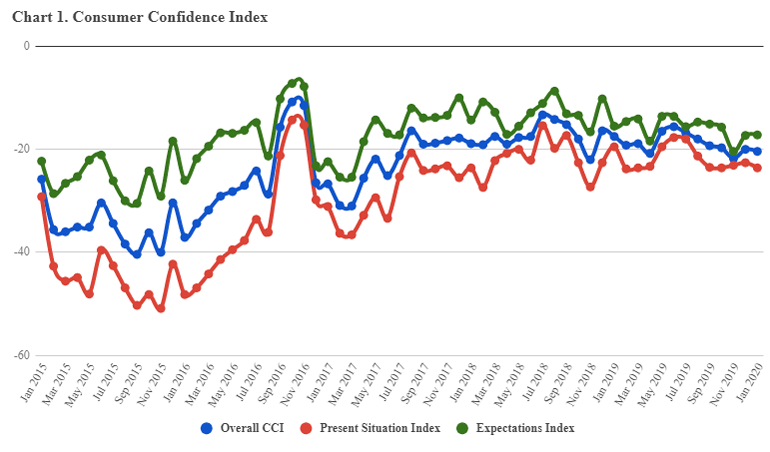

A nationally representative sample of around 350 Georgians, interviewed in early January 2020, reveals that the Consumer Confidence Index (CCI) remained nearly the same, deteriorating by 0.4 index points (from -20 in December to -20.4 in January). Yet, as we observed in December 2019, Georgian Consumer Confidence improved by 1.8 index points. It is worthwhile to observe whether we have the same pattern of Consumer Confidence alterations in December and January every year. Interestingly, since 2012, when we started measuring consumer confidence in Georgia, Georgian consumers seem to enjoy Christmas and New Year Shopping and preparation in December (Consumer Confidence improves in December) and afterwards having a harsh period with less money left after the New Year celebration in January (Consumer Confidence declines in January). This pattern is present every year since 2015. Different pattern of Consumer Confidence fluctuations – consecutive decline in December and January – in previous years is correlated with parliamentary elections, being held in the fall season of 2012 and 2016 and presidential election, again being held in the fall of 2013.

It is worth observing also patterns of the two CCI sub-indices, the Present Situation Index and Expectations Index. Numbers display that the Present Situation Index went down by 1 index point (from -22.6 in December 2019 to -23.6 in January 2020), and the Expectations Index stayed nearly the same, improving by a negligible 0.1 index point (from -17.3 in December 2019 to -17.2 in January 2020), conclusively Present Situation Index being responsible for the slight decline.

Table 1 below shows which particular questions caused the slight decline in Georgian Consumer Confidence in January 2020.

Table 1: January 2020, Changes in Consumer Confidence (Index Points), by Questions

How will your financial situation change, over the next 12 months |

-6.1 |

| Do you expect to increase spending on major purchases compared to the past, over the next 12 months | -1.2 |

| Your ability to save, over the next 12 months | 1.9 |

| General economic situation, over the next 12 months | 3.8 |

| Do you expect prices to increase more rapidly, over the next 12 months? | 1.9 |

| Expected level of unemployment in Georgia, over the next 12 months | 0.7 |

| How did the general economic situation changed in Georgia, over the past 12 months | -0.8 |

| How much did consumer prices rise, over the past 12 months | 2.3 |

| Is now the right time for people to make major purchases in Georgia? | 6.1 |

| Is now the right time for people to save in Georgia? | 0.6 |

| Your current ability to save? | -8.5 |

| Your financial situation, over the past 12 months | -5.5 |

Numbers also reveal that questions concerning present situation are the ones to blame. In particular, “Your current ability to save” and “Your financial situation over the past 12 months” showed the largest negative change. Also, we can notice a high negative change in one of the questions related to expectations – “How will your financial situation change, over the next 12 months”.

Tables 2, 3 and 4 explain why these particular questions demonstrated negative movement in January 2020. Percentages in the tables show proportion of people who belong to one of the mentioned groups in the tables. For instance, 3.9% in Table 2 means that only 3.9% of interviewed people in December are saving a little, while 17.4% of interviewed Georgians in January are running into debt etc.

Table 2: Which of these statements best describes the current financial situation of your household? (or Your current ability to save)

| October/September | November/October | December/November | |

| CCI | -0.4 | -2.1 | 1.8 |

| Tbilisi | -1.2 | -2.6 |

1.5 |

| Rest-of-Georgia | 0.2 | -1.7 |

1.9 |

| Higher Education | -1.6 | -3.2 | 0.2 |

| Without higher education | -1.1 | 0.4 |

4.6 |

| Male | -4.8 | -0.9 | 1.7 |

| Female | 4.2 | -3.0 |

1.9 |

| “Young” | 3.2 | -2.2 | -9.1 |

| “Old” | -0.1 | -1.8 | 7.2 |

Change column in Table 2 discloses the share or proportion changes in the corresponding groups. To name the numbers, share of people who are saving a lot remained unchanged in January 2020 compared to December 2019. Then, share of people who are saving a little increased by 1 percentage point. Afterwards, we observe the largest positive change, 7.3 percentage points, in the share of people who are just managing to make ends meet on their income. And lastly, the share of people who are using their savings and running into debt have increased in January 2020 compared to December 2019 (changes being equal to -4.3 and -5.9 percentage points respectively), which caused the decline in this particular question.

Tables 3 and 4 can be analyzed applying the same logic in order to find out the reason(s) for the drop in the questions related to personal financial situation over the past and next 12 months.

Table 3: How has the financial situation of your household changed over the last 12 months? (or Your financial situation over the past 12 months)

| October/September | November/October | December/November | |

| Present Situation Index | -0.1 | 0.5 | 0.5 |

| Tbilisi | -1.1 | 1.8 | -3.0 |

| Rest-of-Georgia | 0.2 | -2.2 | 5.0 |

| Higher Education | -2.6 | -0.5 | -2.4 |

| Without higher education | -1.0 | 3.4 | 5.6 |

| Male | -7.8 | 1.9 | -0.8 |

| Female | 8.1 | -0.6 | 1.6 |

| “Young” | 0.8 | 0.7 | -12.3 |

| “Old” | 3.4 | 0.7 | 6.9 |

Table 3 illustrates that the share of people whose financial situation got a little worse and stayed the same have increased in January 2020 by 4.7 and 2.4 percentage points, compared to December 2019, these exactly causing the negative movement of this particular question (related to personal financial situation over the last 12 months).

And finally, Table 4 demonstrates that the increased share of people who expect their financial situation to get a little and a lot worse (by 2.6 and 1.9 percentage points respectively) in January 2020, compared to December 2019, drive down the overall result of this question (expectations related to personal financial situation over the next 12 months).

Table 4: How do you expect the financial position of your household to change over the next 12 months?

| October/September | November/October | December/November | |

| Expectations Index | -0.6 | -4.7 | 3.1 |

| Tbilisi | -1.4 | -7.1 | 6.1 |

| Rest-of-Georgia | 0.2 | -1.2 | -1.2 |

| Higher Education | -0.5 | -5.8 | 2.8 |

| Without higher education | -1.1 | -2.6 | 3.6 |

| Male | -1.8 | -3.8 | 4.2 |

| Female | 0.4 | -5.4 | 2.1 |

| “Young” | 5.6 | -5.1 | -5.9 |

| “Old” | -3.6 | -4.3 | 7.6 |

MONTHLY AND YEARLY CHANGES IN THE CCI VARIABLES