The International School of Economics at TSU (ISET) and ISET Policy Institute are looking for a Communications Specialist. Dimension and Scope: &bul...

Read more

![]()

![]()

![]()

![]()

![]()

Hosted and moderated by ISET Policy Institute’s Salome Gelashvili, Acting Head of the Agricultural and Rural Development Policy Research Center,...

Read more

We were thrilled to see Salome Gelashvili, head of the ISET-PI Agricultural Policy Research Center (APRC), actively participate in a UNDP Georgia onli...

Read more

Our latest online presentation highlighted women’s rights in Georgia and crucially considered their role in employment, childcare, and within so...

Read more

On November 8, ISET was visited by Mr. Juha Kahkonen, Deputy Director of the Middle East and Central Asia Department of the IMF, who gave a presentati...

Read more

Considering the significance of a green post-COVID recovery, alongside the importance of maintaining an ecological diverse economy, ISET Policy Instit...

Read more

ISET’s Policy Institute is proud to announce the unveiling of its Regulatory Impact Assessment (RIA) Manual. The ISET Director, Tamar Sulukhia, ...

Read more

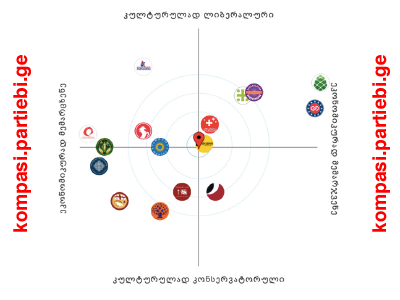

Parliamentary elections are just around the corner. A well informed and empowered citizen is central to the outcome of elections that will be in the b...

Read more

On July 21, ISET Policy Institute (ISET-PI) held an online presentation 'Development of Indirect Impact Assessment Methodology and Multipliers'. The ...

Read more

Under ISET affiliation Luc Leruth, the Lead Economist in the Policy Institute’s Governance and Social Policy Research Center, has recently been ...

Read more

In early February, Dr Leruth gave a presentation to the G20's Task Force on Multilateralism and Global Governance. His address, entitled "Identifying ...

Read moreAccording to the best global practices, residential and commercial real estate price indices are calculated using several measures, namely the Laspeyres index or the Paasche index. Another popular measure, the Fisher real estate index is a combination of the two. These indices heavily depend on the available sample and do not take into account sample volatility across time (for example, the quality of purchased units in the sample may increase over time, which will be reflected in higher prices). One way of remedying this issue is to construct a standardized real estate unit in each time period (using a hedonic regression technique) and to use this unit to obtain quality-adjusted indices. The latter indices are called the Laspeyres hedonic imputation index and the Paasche hedonic imputation index (Handbook on Residential Property Price Indices, Eurostat Methodologies and Working Papers, 2013).

To implement this methodology, we first determine the characteristics of a “typical” real estate unit in each month. This is done for both real estate categories (residential and commercial). For example, to determine a typical flat in any given month we calculated the median of the log area of the property advertised in that month, mode of renovation type, mode of district, median of the number of bedrooms, median of the number of bathrooms, and median of the number of balconies. Similarly, to determine a typical commercial area, we calculated the median of the log area of the property, mode of renovation type, mode of district, median of the number of rooms, and median of floor.

Second, we construct a linear regression model on the data in each month using unit price in log form as a dependent variable and controlling for various characteristics of the real estate unit. In the case of flats, we control for the following: the log area of the property, type of renovation (We combine nine categories (black frame, white frame, not finished white frame, no renovation, renovation needed, renovated long ago, renovation in progress, renovated, newly renovated, euro-renovation) into three renovation types: frame, old, and new), district (Vake-Saburtalo, Old Tbilisi, Isani-Samgori, Didube-Chughureti and Gldani-Nadzaladevi), number of bedrooms, number of bathrooms and number of balconies. In the case of commercial units, the log area, type of renovation, district, number of rooms, and the floor the property is on were used as control variables. In short, the general exposition of the model is the following:

Where Pt is the price of the real estate unit in period t, Z1, ..., ZK is the characteristics vector of the unit, and is the error term. (The dependent variable is transformed due to the fact that real estate prices tend to have a log-normal distribution).

The regression coefficients tell us how different characteristics of the real estate unit (e.g. location, number of rooms, etc.) affect the price of the property. Clearly, when we repeat the regression for every month, we will obtain different estimates of the coefficients for each month.

The coefficient estimates and the characteristics of a “typical” real estate unit are then combined to calculate both the Laspeyres and Paasche monthly indices.

The two indices differ in the way they combine the coefficients and the “typical” unit characteristics. The exact formula for the Laspeyres hedonic imputation index is:

Where a vector is the standardized real estate unit of period (the base period. March 2013 was taken as the base month).

As one can see, the Laspeyres index keeps the unit characteristics constant over time. It takes the “typical” housing unit from the base period (March 2013 in our sample) and compares the price of this unit in any given month t to its price in the base month. The Laspeyres index answers the question: what would be the relative price today of a real estate unit that was typically offered for sale (or rent) in the base month?

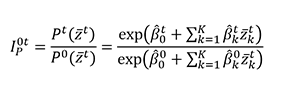

The Paasche hedonic imputation index is somewhat different:

The Paasche index takes the characteristics of a “typical” real estate unit advertised in month t, and compares the current price of this unit to the price it would have had in the base month. Essentially the Paasche index answers the question: what is the price of a typical real estate unit today relative to the price of the same unit in the base month?

Both of these indices have advantages and disadvantages. The Laspeyres index could possibly overstate any price increase, as it would not account for substitutions towards cheaper (e.g. smaller or in a less prestigious area) real estate units as prices increase. At the same time, the Paasche index could understate any price increase for the same reason – it would “allow” people to substitute lower quality housing options as prices go up.

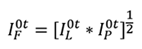

The best way to reconcile both measures is to obtain a Fisher-type hedonic imputation index – the geometric average of the Laspeyres and Paasche indices:

The Fisher index is used as the main indicator of real estate price movement in our report.

On the 13th of November, ISET was visited by Joey Cherdarchuk of Darkhorse Analytics, a Canadian company specializing in data science and information design. The firm is dedicated to helping organizations and individuals present their data in a clear...

Read more

September 17-18 2018, the APRC’s Rati Kochlamazashvili and Pati Mamardashvili conducted a training exercise for Civil Society Organizations (CSO) running Social Enterprises (SE) in value chain analysis and development. In the recent years, SE ...

Read more

Georgia committed to harmonize its electricity market legislation with EU Third Energy Package and liberalize it according to the accession protocol with the Energy Community. These structural changes are expected to contribute to a more efficient fu...

Read more

ISET Policy Institute collaborated with Gesellschaft für Internationale Zusammenarbeit (GIZ) starts a training course about integrating ecosystem services into local development planning. Integrating Ecosystem Services into Local Development Pl...

Read more

ISET-PI trains Competition Agency of Georgia Staff in the basics of econometrics and STATA. The objective of the training is to strengthen the capacity of the Competition Agency staff to use STATA to conduct independent data analysis, run OLS regress...

Read more

ISET is implementing a new training program, "Economics, Finance and Banking," with VTB Bank. The aim of the program is to introduce VTB Bank's employees to the major principles of economics, finance and banking. The training program is now being co...

Read more