- Details

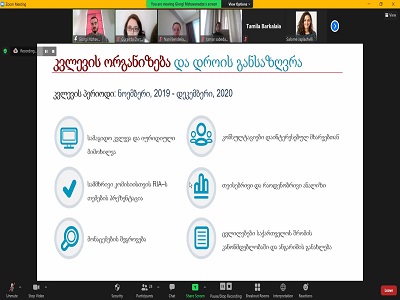

Our latest online presentation highlighted women’s rights in Georgia and crucially considered their role in employment, childcare, and within society. ISET began research on our latest regulatory impact assessment (RIA) in 2019 and concluded at the end of last year, the subject brought to light many significant points relating to female economic empowerment and parental leave.

We would like to thank Tamila Barkalaia, the deputy minister of the Ministry of Internally Displaced Persons from the Occupied Territories, Labour, Health and Social Affairs of Georgia, who kindly offered her views on ISET’s latest research on economic empowerment. She underscored how women’s economic activity has regularly been hampered and that, without change, women will continue to lag behind men. The deputy minister continued to point out that by assisting women in the workplace, offering maternity protection, and considering anti-discriminatory practices and the government’s role in protecting women in the labor market, Georgia can make significant improvements in the protection of women’s rights.

- Details

On November 8, ISET was visited by Mr. Juha Kahkonen, Deputy Director of the Middle East and Central Asia Department of the IMF, who gave a presentation on the fact that global trade tensions and slowing growth amongst key trading partners are affecting the Caucasus and Central Asia (CCA) region. However, Mr Kakhonen explained that despite a decline in export growth, a looser fiscal stance and rising retail credit is expected to maintain a broadly stable growth for the region in 2019–20

The IMF’s CCA Deputy Director then examined the issues in-depth and stated that in order to foster higher and more inclusive growth and raise living standards, CCA policymakers should strengthen competitiveness, leverage comparative advantages, and foster diverse sources of growth to reap the gains from trade and integration into global value chains. In addition, revitalizing FDI by easing restrictions and promoting macroeconomic stability while deepening domestic financial markets can provide more stable sources of funding, mitigating the risk of volatile portfolio flows. These portfolio flows to the region’s economies are nearly twice as sensitive to global market sentiment compared to other emerging economies, exposing the region to abrupt shifts.