- Details

On 26 September, the World Economic Forum published The Global Competitiveness Report 2017–2018. The full report contains detailed profiles and rankings for 137 countries based on 2016 data.

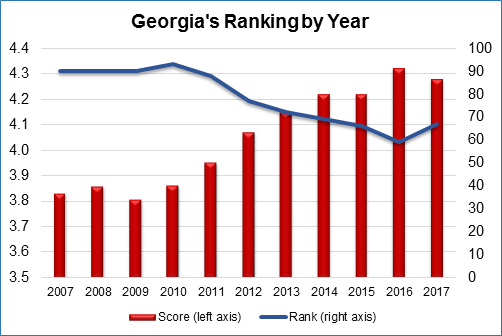

This year, Georgia is ranked in 67th place, which is an eight position deterioration compared to last year. This is the first drop in the rankings that Georgia has experienced since 2010. To quote the report, “although the overall trend is positive for most Eurasian economies, there is little sign of convergence within the region. Its most competitive economies, including the Russian Federation (38th, up five), are maintaining their edge. This year’s most improved Eurasian economy started from a low base: Moldova moves up 11 places to 89th. Others, that had been catching up in past years are slipping back, with Georgia (67th) and Kazakhstan (57th) losing eight and four places respectively”.

- Details

On June 7, during his visit to Georgia, Mr. Anthony De Lannoy, the Executive Director of the IMF who represents Georgia along with the other 15 countries at the IMF Board of Directors, addressed an audience of ISET researchers, students and management, as well as senior representatives of the National Bank of Georgia, with an overview of the IMF and its cooperation with Georgia.

Mr. De Lannoy spoke of the IMF as an institution, and described its history, structure, functions, instruments and its evolution.

He further explained that the IMF’s activities include surveillance, in which the IMF acts as a global monitor over the economic, financial and exchange rate policies of its members, and a catalyst of the countries’ economic development; it provides to capacity development by providing technical cooperation support and contributes to policy analysis of various beneficiaries; and it extends lending, which is realized in its own currency Special Drawing Rights or SDR, which is the IMF’s own currency with 1 SDR being an equivalent of ca. 1.36$, through a range of financial concessional and non-concessional instruments, such as “precautionary and liquidity credit lines”, “extended fund facilities”, “standby arrangements’, “rapid credit facilities” and others, depending on the needs of the IMF members in covering their payment imbalance and their quota at the Fund (i.e. the members’ voting rights and access to funding relative to the amount of their contribution and their economic standing).