- Details

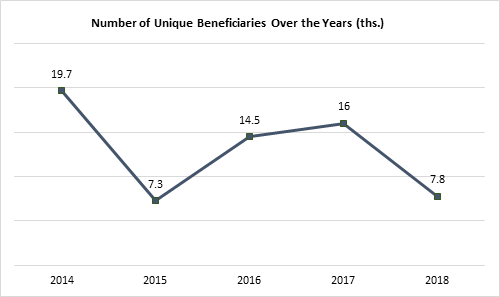

An agro insurance program was started in September 2014. The program is subsidized by the state and eight insurance companies participate in the program. The insurance package covers losses caused by hail, flooding, and storms, as well as by autumn frost (covered only for citrus). Since the beginning of the program, 49.3 thousand farmers (unique beneficiaries) have purchased insurance. The demand was particularly high in 2014 and dropped afterwards due to the reduction of the state subsidy from 90% to 70%, advancements to the program start date in later years, and the introduction of new requirements throughout program implementation.

- Details

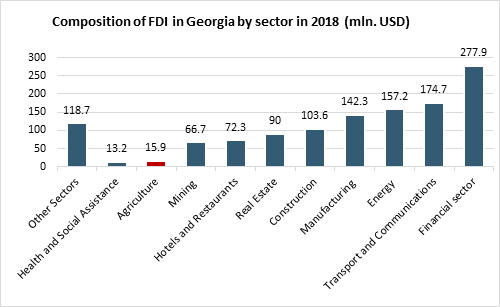

In 2018, FDI in agriculture constituted 15.9 mln. USD. While the total FDI in 2018 was lower than in 2017, FDI in agriculture has significantly increased (by 28.2%). The highest FDI in agriculture was observed in the second quarter of 2018, while there was divestment (negative FDI) in the first quarter of 2018. The divestment was quite small and was followed by a significant increase in other quarters. Given that demand for food is likely to increase in the future, FDI in agriculture is critical for the expansion of agricultural output.

- Details

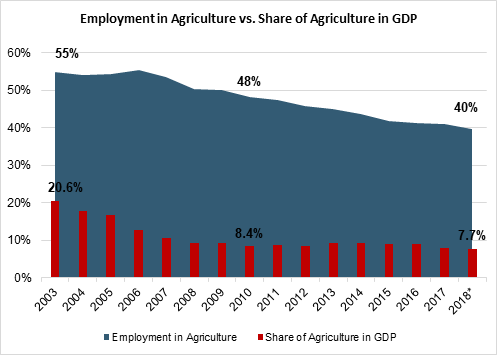

According to GeoStat’s preliminary data for 2018, Georgia’s economy grew by 4.7%- the same rate as in 2017. As 2017 was a challenging year for Georgian agriculture, the sector experienced -3.8% negative growth. Unlike 2017, agriculture in 2018 had a positive and rather modest growth rate of 0.7%. As expected, agriculture keeps proportionally shrinking within the country’s overall GDP- it stood at 7.7% in 2018 compared to 8.0% in 2017.

The weak stake of agriculture in the overall GDP is not necessarily an issue, given that the world average was 6.4% in 2017 (CIA estimate). The figure is even lower in developed countries, which vary between 1% and 3%. Thus, the decline would not be harmful to the Georgian economy, if not for the fact that around 40% of the labor force is still employed in agriculture. According to the World Bank estimate (2018), the world average employment in agriculture is 26%, though it does not exceed 5% in the developed world (OECD countries).

- Details

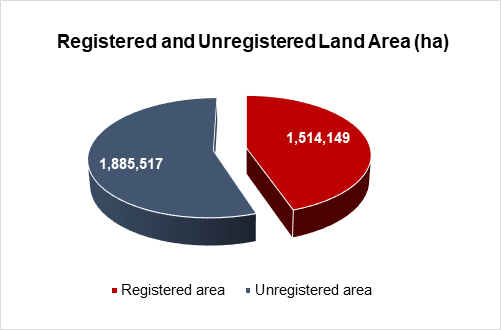

Underdevelopment of the land market is a major obstacle behind the development of Georgian agriculture. A significant number of unregistered plots of land prevent land consolidation and increases in agricultural productivity. According to the Ministry of Justice, as of February 2019, in the framework of the land registration reform, since 2016, there are 543,139 citizens who have registered 130,943 ha of land; 1,431 legal entities which have registered 1,793 ha; and 34,131 state entities with 169,241 ha of registered land. Thus far, until 1 August 2016, 1,212,173 ha of land had been registered and an additional 301,976 ha have been registered since then. Therefore, the total area registered is 1,514,149 ha, which accounts for 45% of all agricultural lands, leaving 55% remaining unregistered. As for the regional distribution of lands registered after 1 August 2016, the largest area was recorded in Kakheti, whilst the greatest number of plots was in Imereti (see Figure 1). The average size of a registered plot is 0.5 ha.