Georgia is flooded with cheap Turkish products: tasteless winter tomatoes, clothes, construction materials, you name it. Turkish goods are everywhere – in specialized shops in central Tbilisi, supermarkets, and the Eliava Bazroba. Is this happening because Turkey is our neighbor, because Georgian people love Turkish products, or what?

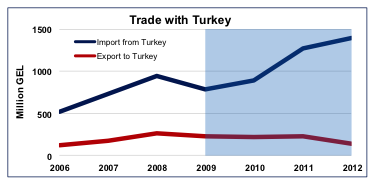

Turkish exports to Georgia have been growing very fast since the Rose Revolution but they received an additional push in 2009, following the signing of a bilateral free trade agreement (FTA) between the two countries in November 2008. At $1.4bln (17% of total imports), Turkey was by far the largest source of imported goods to Georgia in 2012, with Azerbaijan, Ukraine, China, Germany and Russia trailing far behind. Conversely, the FTA had no visible impact on the Georgian exports to Turkey. In 2012, Georgia’s exports to Turkey amounted to a meager $142mln, significantly less than in 2008.

Now, while the availability of cheap Turkish goods does undoubtedly benefit the majority of Georgian consumers, the same cannot be said of many Georgian producers and those consumers who lost their jobs or had their wages cut due to competition with Turkish imports. Thus, an argument could be made in favor of revoking the FTA or offering selective protection or subsidies to specific sectors of the Georgian economy.

There are different viewpoints on whether protection of domestic industries is desirable in the first place. Before the rise of modern economics, most countries stuck to a policy of promoting exports and discouraging imports. This was the doctrine of mercantilism, personified in Jean-Baptiste Colbert (1619-1683), the famous minister of finance under the French king Louis XIV. Then, in the 19th century, liberal economists pointed out to the advantages of open markets and free trade. The politically most influential ideas in this respect were due to David Ricardo (1772-1823), a London businessman who wanted to convince his government to reduce trade barriers. He invented the Ricardo Model, a benchmark of trade economics still today.

While in the 19th century most economists agreed that free trade was beneficial in general, thinkers like Friedrich List (1789-1846) claimed that there were benefits from temporarily protecting the so called infant industries. The infant industry argument applies to those sectors of the economy that are capable of competing internationally if allowed to grow and reach critical size and maturity. According to this line of thought, protective measures should be abolished once an infant industry matures and reaches productivity levels that allow it to compete internationally. If exposed to international competition at an early stage of development, such an industry would be doomed to extinction. While more nuanced and mathematically sophisticated, much of the debate in modern international economics still oscillates between Ricardo and List, i.e. free trade and infant industry protection.

Protectionist policies could be supported for other reasons as well. For instance, a large country (or customs union) may want to protect its domestic market in order to create the incentives for foreign producers to locate own production or assembly plants in that market. This has been the rationale for the massive Japanese and Korean Foreign Direct Investment in the US and EU automotive industries. Protection-induced technology-intensive FDI created hundreds of thousands of jobs and provided for technological spillovers to other sectors of the economy.

Before we subscribe to the protectionist view, it is important to realize that a) this argument does not apply to Georgia given the small capacity of its domestic market and b) because Georgia is small, it can only receive FDI by lowering the cost of trading and gaining access to large neighboring markets such as Turkey, Azerbaijan and, eventually, Russia. Already today, the FTAs that Georgia has with Turkey and Azerbaijan (the major destination for Georgian exports) provide incentives for Turkish and Azeri businesses to locate production in Georgia so as to export – at very low cost and no customs tariffs charged – back to their domestic markets. This, for instance, has been the rationale for Turkish investment in the Georgian light industry (mostly in Batumi and Ajara). As a result, Georgian exports of “women’s blouses” (according to GeoStat) to Turkey reached $7.3mln in 2012, up more than 20% compared with 2011. Hopefully, this is just the beginning.

Given Georgia’s renewed commitment to developing and modernizing its agriculture, it may want to review its trade policy with respect to certain branches of agricultural production (winter tomatoes, for example). Since Georgia is a WTO member, however, its policy choices are limited. If Turkey is bending or breaking the rules to block imports from Georgia, then the dispute settlement mechanism is the way to go. It takes time, but this is how civilized countries are supposed to solve these sorts of disputes. While Georgia may not be able to reinstall border tariffs, it could provide selective protection through measures included in the so-called “green box support” such as subsidies and government programs that are deemed to be minimally or non-distortive. For example, included in this category are government expenditures on research and development, infrastructure, decoupled payments to farmers, etc. They all cost money, unlike an import tariff that actually raises revenue, so they may not present an attractive alternative. Insurance schemes for farmers (price or income insurance, for example) are also “green box”, although they can clearly distort incentives.

Finally, a word of warning. When considering protective measures in agriculture, the government should not lose sight of consumer interests. International commodity prices have been very high in recent years, forcing many governments to block exports or lower import tariffs so as to reduce domestic prices and gain political stability. The latter is not something the new Georgian government would want to risk.

Comments

There have been unofficial barriers to food imports to Georgia for some years, including eggs and chilled beef. These are now being dismantled. This should provide a powerful incentive for domestic producers to invest in improvement of their facilities and practices.

Rather than erecting tariff barriers to food imports, and get caught up in a trade war, it would make sense to engage in strategic reductions in the government impost on agribusiness. For example:

* Abolish all excise on diesel fuel for farm use (a major component of cost of production) which is commonly done in many countries

* Zero-rate all VAT liability on farm inputs, which would improve cashflow substantially.

* Introduce a tax-deductible allowance of 100% depreciation of assets within a year of purchase, which would stimulate investment in new agricultural and food storage infrastructure.

* Reduction or abolition of land tax on cultivated land in production.

* Replace land tax liability with obligation to purchase crop failure insurance, to foster the local farm insurance industry. This would broaden the base of policy holders and bring premiums down (currently 3 x the price of a developed country).

* Abolition of property taxes on farm and food factory infrastructure.

* Reduction of irrigation water tariffs

* Reduce income tax on agricultural production to match that of regional neighbours e.g. Russia 6%, Ukraine 0%

*Zero-rate income tax on profits reinvested in the enterprise.

*Abolish capital gains tax on agricultural land and food processing entities.

*Abolish dividends taxes on distributed dividends from agribusiness

These reforms would be within the spirit of WTO, while stimulating local industry and reducing the cost of doing business, allowing local firms to compete with heavily subsidised foreign imports. They would help keep food costs down for the urban poor also.

I totally agree that those instruments will be very beneficial for development of Georgian agricultural production at some point. BUT are those things essential at current moment? What is the sense of giving gold bullion to the person drowning in the ocean? Gold is good when you are safe. If our farmers have all those privileges,I think, it will not bring us to the desired result. The main reason of inefficiency in Georgian agricultural production is the scale. Why not cooperation (like Farmer cooperation in Nikozi. See the blog by Eric Livny assessing the experiment http://www.iset.ge/blog/?p=769)? There is a big opportunity for business. Why this is not happening? Maybe there is a lack of knowledge and/or awareness?

Another problem which need to be addressed is a seasonality of the production. It is essential to invest in greenhouse production and properly working warehouses for the harvest. Otherwise, further increase in production in the summer/autumn might worsen the situation.

Reducing taxes is hardly "giving gold bullion" to investors; they have to raise bullion on their own at very high premiums to account for Georgia's sovereign risk and small population. The net tax burden on mid-sized farmers in Georgia is amongst the highest in the world.

Development of the rural sector requires a balanced approach between encouraging corporate investment in production and processing, strengthening smallholder capability, and improving basic government services; these are three legs on the one pot. The new government is addressing the latter two issues, and hopefully shall address the first in good time. Neglect of any of these three factors will result in utter failure.

If one looks eastwards, one will see that robust developing economies strengthen their rural sectors using the private sector, including MNC's, as the major engine of growth. They offer very attractive concessions to lure domestic capital out of the capital cities, and foreign capital, to fuel this process. Such concessions usually oblige co-operation with smallholders in supply chain development. The double-digit rates of rural economic growth under such conditions are far superior to the lame performance of states burdened with high taxes and complicated transfer payments.

Quite apart from Georgia's WTO obligations, Georgia will be further locked into zero tariffs for EU imports from November 2013 onwards if, as planned by both parties, the Deep and Comprehensive Free Trade Agreement (DCFTA) is signed.Georgian politicians and (most) economists take the view that this agreement will in the long run be beneficial. I am out of the local loop at present, struggling with policies and measures to protect agriculture in Bosnia and Herzegovina, which has equally serious probles to Georgia, so I do not whether the Government is trying to negotiate concessions for infant industries. If they are, you can rest assured that the EU will ensure these are strictly time limited, since they will be treated as derogations from the overall objective of free trade betwen EU and Georgia.

Thank you for the blog. Much more could be said concerning the topic. I will

only mention two points:

A. Negative effect of trade opening : the neoclassical trade theory assumes

- among others - full employment and no adjustment costs. The country has

just to move on the production possibility curve to another point. However,

moving to free trade needs internal adjustment and may lead to structural

unemployment for some time. Hence, the negative effects of moving to free

trade will be smaller if the ability to adjust is high and opening up of the

country will be gradually over time and announced clearly and definitely.

Moreover, adjustment aid can help to minimize the negative effects. I am

afraid that the agricultural sector of Georgia is not very competitive. Most

farms seemed to follow the rationale of being a subsistence farmer. Hence,

the government has to provide adequate public goods, most of all to develop

markets.

B. Positive effects of trade opening:

1) Free trade allows for movement of capital, hence FDI in the liberalizing

country does normally increase. More investment leads to an increase in

employment and growth

2) Free trade allows to import new technologies and shifts the production

possibility curve outwards.

3) Free trade increases competition on domestic markets. This effect is of

most importance for small countries.

Very interesting article, and unfortunately too painful problem for Georgia, especially when Agriculture is crucial for the country and can and should be one of the priorities. As Georgian, I wish to see rigid steps from Government based on interest of general public of the country, including partial protectionism, which I'm sure will be considered wrong from EU and our government will have hard time from them, but before we will do it we should not forget one vital issue: IS GEORGIA Ready for that ? Are Georgian farmers ready for that ? All these notions provided by all of you gentlemen of course are important and right, but key thing to be done FIRST OF ALL is education and learning, we need to change mentality asap and attract younger and open minded people to Agricultural sector. Something like I have seen in the US - a person up to 30 YO declaring the desire to be a farmer is fully supported and this support is not only money, but technical assistant including education, agricultural consultants which are obliged to teach farmers as well. This is a first crucial step to start development of Agriculture. Of course, in parallel taxation and trade issues should be adjusted fitting it to at list putting Georgian farmer in equal position with competing imports.

You are absolutely right, Alex, that education for farmers is very important in developing competitiveness and self-sufficiency for farming families. The best teachers of the disciplines and techniques of farming are usually your parents on the farm, but in Georgia collectivisation damaged that traditional structure. A mixture of formal vocational training, field days, access to Georgian language technical TV programmes and press, and maybe even remote learning may be important in developing technical and business skills.

Georgia unfortunately does not have the financial resources for all of this to be provided on-demand for free, as in US or EU, but maybe some government subvention is possible. Another option worth considering is approved-supplier training programmes run free of charge by food processors; many developing countries have achieved impressive farm productivity gains by this method, with food processors benefiting from more consistent supply, better quality and safer raw materials.