It is a commonly accepted view that corruption is bad for economic growth. It leads to an inefficient allocation of resources by contradicting the rules of fair competition and by setting wrong incentives. Patronage and bribery are two components that define the notion of corruption and which cause the inefficiencies associated with it. Patronage often leads to the unfair delegation of the power of decision making to economic agents who do not posess the relevant skills to make good decisions. In the absence of patronage, ceteris paribus, the power of decision making would be delegated to more qualified economic agents.It turns out that the opportunity cost of delegating decision making power through patronage is higher than the benefits of such delegation, which is inefficient in the sense that it decreases social welfare. Bribery is yet another “evil” which in theory could help implement bad decisions, that is decisions which are beneficial for few but Pareto deteriorating for society.

As intuitive, logical and familiar as the arguments against corruption may sound, people often do not take into account the fact that counterarguments exist. We like to think that corruption is straightforwardly bad. This is because political thought has protrayed corruption as an unethical activity – it has become a commandment that corruption is unacceptable in any shape or form; even mentioning the word “corruption” elicits bad feelings. So, in order to get rid off those biased bad feelings and to enable us to start thinking about its advantages, let us for a moment retitle “corruption” in our minds and call it “a favor”.

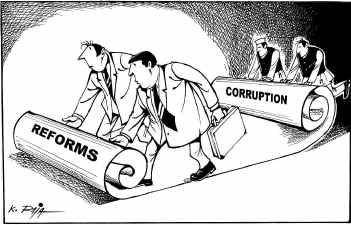

Although uncommon, that notion that corruption might be sometimes good is not a new idea. Heckelman & Powell (2008) did a cross-country study in which they examined the effects of corruption on economic growth. They found out that corruption could be either harmful or beneficial to growth depending on a given institutional environment. When the size of government is big and regulatory and bureaucratic burdens are harsh, then corruption has a positive effect on growth. Thus, according to their results, reduction of corruption is favorable for growth only when political and, more importantly, economic institutions are strong. The argument is rather simple: with weak institutions and no corruption, it usually takes many burdensome procedures, much time and additional monetary costs for economic agents to implement any decisions. If, on the other hand, those economic agents were able to pay bribes to avoid such time and monetary costs they would become more efficient and competitive.

The case of Georgia, I believe, is similar to the “weak institutions – a bit of corruption is good” situation. Gwartney & Lawson’s “Economic Freedom of the World Annual Report 2012” measures economic freedom in 144 countries based on five major areas: size of government; legal system and property rights; sound money; freedom to trade internationally; and regulation of credit, labor and business. The overall index ranks Georgia 42, which puts the country in the pool of Albania, Costa Rica, Bulgaria, Rwanda, the Bahamas etc. Among those five areas, the index ranks Georgia lowest in the size of government (83).This indicates that the size of the government is quite large and thus, bureaucratic burdens are present. Marshall & Cole’s “Global Report on Conflict, Governance and State Fragility 2011” provides yet another index for measuring the strength of political and economic institutions. According to that index, Georgia is moderately fragile in the economic effectiveness indicator. Overall, Georgia’s political and economic institutions are considered to be “low fragile”. These two indices indicate that, despite the favorable institutional reforms which took place during the past decade, Georgia still suffers from institutional inefficiencies and lacks economic freedom.

To support the hypothesis that, in Georgia’s situation, a bit of corruption would help, we can refer to a specific case. According to several Georgian entrepreneurs with export orientated businesses, the fact that Georgia is the only incorrupt country in the region frequently works against Georgian exporters. For example, when products are being exported to Azerbaijan or Kazakhstan, or need to go through those countries, Georgian exporters face problems at the borders because of a lack of Caspian Sea ferries or corruption in the port of Aktau. If exporters want to pass these borders without delays, they have to pay bribes. However, because of the harsh regulations currently in place, Georgians cannot pay such bribes. This directly affects product prices and the competitiveness of Georgian goods on external markets. This case also makes us think about corruption and institutional strength in broader terms. When assessing the advantages and disadvantages of corruption we should not only consider institutional problems inside the country, but should also think about such problems on a regional level.

Comments

The last part about the region reminds me of the prisoners' dilemma __ if everybody else is corrupt, maybe it is better to be corrupt yourself also. However, I am more sceptical about going back to corruption for the sake of exporting our goods to corrupted countries. There are many more export destinations, I believe. Additionally, corruption has its merits, and most important for me out of those are transparency and predictability.

Is it prohibited for Georgian entrepreneurs to pay bribes abroad? Georgia should reconsider that rule. Until a few years ago, German companies could deduce bribes they paid abroad from their taxable profits, i.e. bribery abroad was subsidized by the German government. Still today, I think one cannot sue Siemens in Germany if they bribe Greek government officials (though in Greece one could). Georgia should also focus on the corruption within its borders and not make life difficult for Georgian businessmen abroad who adjust to local "business standards".

Giorgi,

I agree with the discussion in your blog up to the point where you make the link to Georgia. The thumb rule provided by Heckelman & Powell (2008) is this: "when the size of government is big and the regulatory and bureaucratic burdens are harsh, then corruption has a positive effect on growth".

Now, the international indices you reference are not really saying much about the actual quality of Georgia’s regulations. Anybody with eyes to see would say that Georgia’s “size of government” is quite reasonable and the “regulatory/bureaucratic burden” the Georgian government imposes on businesses is close to the minimum. This is precisely why Georgia ranks so high in Doing Business. Who would even want to bribe a government official for shortening the time needed to complete a registration procedure or getting goods through the customs or out of the Poti Port. The latter, for instance, is a major headache in Turkey, as we were told by the President of MAERSK-Georgia, creating a competitive advantage for Georgia as a trade corridor to Azerbaijan and further to Central Asia. Imagine a customs official from the Shevarnadze era waking up from a 10-year lethargic sleep and trying extract bribes from importers. First, he would fail to make any money, and second, he would find himself behind bars within a day or two.

Your policy prescriptions are perfectly applicable in Azerbaijan and Armenia, where the quality of regulations (as you are saying in the last paragraph) leaves much to be desired. And, as we’ve learned from our business interviews, Georgian businesses trading with its neighbors found the ways to overcome the regulatory barriers by engaging local partners who are not subject to the Georgian law. The Georgian businesses turn a blind eye to whatever their local partners are doing, and laugh all the way to the bank.

I think that having no corruption in terms of imports is beneficial for Georgia. For example, the regulation in this sphere can reduce prices and bring competitiveness in comparison with region countries. However, I don't completely agree with one statement in your blog. You wrote that tough regulations by Georgian government could reduce the effectiveness of exports of Georgia

My question is that how Georgian officials could determine the facts of bribes taken place in other region countries as these amounts are not reported in any document?