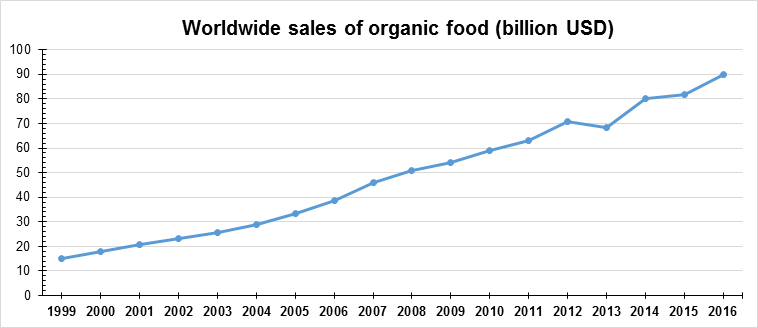

Year by year, interest in the organic market is increasing all over the world. According to STATISTA, worldwide sales of organic food quintupled in the 21st century (18 billion USD in 2000, versus 90 billion USD in 2016), while, according to TechSci Research, the total worth of the market is projected to grow at a compound annual growth rate (CAGR) of 16.15% during the period 2017-2022. In fact, in some developed countries, the growth of supply of organic foods cannot keep up with the growth of demand (OCA, 2018), as the transition from conventional to organic farming is a prolonged process.

WHY ORGANIC?

The growing interest in organic food can be explained by people’s increased concern with a healthier and safer diet, as well as their desire for a more sustainable environment. In particular, the intensification of agricultural technology has increased skepticism towards conventional farming, which has been increasingly relying on chemical fertilizers and pesticides, with possible negative impacts on human health and the environment. Notwithstanding, some studies point that conventional farming outperforms organic farming in various environmental ways (GLP, 2016). Moreover, despite some findings that organic food has less pesticide residue and is more nutritious, the health-related benefits of organic produce remain a highly debated topic. All this controversy, however, does not prevent the organic food market from attracting an increasing number of high-income consumers, especially from North America and Western Europe, where the population better understands the benefits of consuming organic food, and people are willing to pay the accompanying price premium.

Organic food price premiums, by the way, are not trivial and may exceed 100% for dairy or meat products in some regions. The Food and Agriculture Organization of the United Nations (FAO) lists various factors that increase the costs of organic farming, and partly explains the resulting high prices. High prices are considered to be the main constraint for further expansion of the [organic food] market, but there is additional constraint that should not be understated; that is, most consumers do not understand what is really meant by the label “organic,” as the label is still being standardized and differs across countries. These constraints explain why consumers are not willing to pay even more for organic products, despite the increasing interest in these products.

ORGANIC PRODUCUTION IN GEORGIA – THE “SHIRAQI” EXAMPLE

Interest in organic food is also increasing in Georgia. During workshops, forums, or discussions about agriculture, you will frequently hear that Georgian agriculture has huge potential for supplying organic products, and thus should target this high-value market segment. Not using chemical fertilizers or pesticides for a long time in traditional, small-scaled farming in Georgia, as well as rapidly increasing demand for organic products throughout the world, are among the frequently used arguments for expanding organic production in the country.

Some Georgian producers have already decided to try their fortune in organic farming. Shiraqi, which in December 2017 obtained an organic certificate for producing raw cow milk, is one of them. Actually, this is the first case in the Caucasus that a farm has received an organic certificate for animal produce.

The founder of Shiraqi, Nikoloz Benianidze (whom we interviewed recently), says that he became interested in organic farming after hearing about it at various national and international seminars, as well as visiting organic farms abroad. He thinks that Georgia should focus on producing healthy and environmentally friendly products. According to Nikoloz, because of the intensification of agriculture (mainly the increased use of fertilizers and pesticides) associated with negative impacts on human health and the environment, the developed world is increasingly switching to safer and more environmentally friendly farming practices (one of which is organic farming). Developing countries like Georgia could skip the step of such intensive input use, and focus on the sustainable intensification of agriculture from the very beginning. “The aim of the company is to produce the amount of organic raw cow milk that will be enough to substitute for milk powder in the country,” Nikoloz says.

Four years of hard work

Nikoloz’s farm is located in Dedoplistskaro (Kakheti) and employs 100 workers (plus 100-150 additional workers during the high season). The company brought 200 Dutch breed cows (Holstein Friesian Cattle) from Estonia, which cost them around EUR 2,500 per cow. This gave them a capacity of producing over four tons of raw milk per day.

It took four years for Shiraqi to get their organic certificate. The specific requirements for organic milk production can be grouped as follows.

• First, everything starts from the animal’s diet. Cows should be fed with organic feed. Shiraqi has its own land plots for production of organic cereals (wheat, maize and barley), and makes silos for their cows. Because the cereal production process must also follow organic standards, the farm does not use any mineral fertilizers, chemical pesticides or herbicides. Use of hybrid seeds is not allowed either. Therefore, Shiraqi only uses organic fertilizers (manure) and compost, which is also produced on the farm. Large groups of workers are hired during the season for weeding. According to Nikoloz, this doubles the costs usually needed for fighting weeds. Overall, on a modern farm with improved breeds, daily feed cost per cow is 25-30 GEL in organic farming, while it is only 12-15 GEL in conventional production. Animal premixes are also not used on Nikoloz’s farm, and this reduces the milk yields.

• Second, the use of medical drugs is also restricted in organic animal production. According to these rules, alternative treatments (such as homeopathy or phytotherapy) are preferred over conventional drugs. The focus is on preventive measures such as better rearing conditions, adding acids to the water, or probiotics to the feed, as well as following a recommended vaccination schedule. Only in cases when such alternatives are not effective will antibiotic use be allowed. However, after using antibiotics, the milk cannot be used for the next two weeks, while in the conventional production the waiting period is only one week.

• Third, cattle housing must meet specific requirements. Large indoor and outdoor areas must be allocated per animal (6 m2 and 4.5 m2 per cow, respectively). Also, the height of the stable should follow specific rules. In organic production, it is not allowed to hitch an animal. Nikoloz estimated that overall, the stable with all above-mentioned requirements, as well as the specific equipment (milking, etc.), require around $5,000 per cow.

These and other rules (e.g., specific breeding requirements) in the organic farm system are related to animal welfare, a better environment, and a safer final product. According to Nikoloz, these requirements compromise milk yields, which are 20-22 liters a day in organic farming, while the conventional farming provides 30-35 liters a day (on farms with modern breeds and practices).

The projected retail price of one-liter milk is between 4.5 and 5 GEL (about 1.4 times higher than non-organic milk), and one kg cheese price made from this milk will be sold at around 28 GEL (about 2.4 times higher than non-organic cheese). Shiraqi’s main selling market is Tbilisi; they already sell their conventional dairy products to Carrefour, Fresco, Nikora, etc. The company is also going to sell milk to Natural + (the latter also obtained an organic certificate this month) that will sell it under its own label.

Nikoloz is sure that there eventually will be demand for his organic dairy products. However, the segment is in the early stages of development, and will require a lot of effort from all the value chain actors and supporting bodies. “Time is needed to increase awareness of organic production in Georgia. Neither consumers nor managers of supermarkets are well aware of all the benefits of such products,” Nikoloz says. Moreover, problems such as fake labels and expensive laboratory services are also quite severe.

HOW MANY ARE THERE?

In Georgia, a certificate for organic production is issued by Caucascert. Their certificate is legally recognized in Georgia, as well as in all EU countries and Switzerland. They are issuing certificates for four different group of products: (i) Unprocessed plant products (plant production and wild plant collection), (ii) live animals or unprocessed animal products (including honey), (iii) processed agricultural products for use as food (including organic wine), and (iv) vegetative propagating material and seeds for cultivation. According to Caucascert’s latest (20/02/2018) information, in Georgia, 28 producers have gained organic certificates, among which four are concentrated on producing agricultural inputs. Moreover, 40 producers are “in conversion,” which that means that they are at the preparation/control stage for receiving an organic certificate.

These numbers indicate a rather small supply base of organic products in Georgian agriculture. But the interest is gradually increasing, and Shiraqi is one good example. While it not yet obvious in Nikoloz’s case, a well-managed organic business might come with several economic advantages related to reduced production costs and/or higher returns (e.g., Delate, et al, 2003; Chase et al., 2008). Superior profitability of organic farming over conventional farming is less clear in animal production (e.g., Butler, 2002), though some research (e.g., McBride and Green, 2008) points out that entering the industry at a large scale, or utilizing pasture as the primary source of feeding, makes organic dairy production highly profitable.

Developing organic value chains requires even more coordination (e.g., communicating and controlling many specific rules) than other value chains. Targeting this high-value food segment, however, has potential to contribute to employment and the incomes of poor farm households. That’s why our farmers and agribusinesses should keep their eyes open for this fast-growing food market segment in developed countries. Moreover, more holistic movements, such as biodynamic agriculture, has already received a substantial following in Europe and the United States (See our previous blog on biodynamic viticulture). Georgia, with its long traditions, can surely gain some share in special niche markets such as organic and biodynamic production.

Comments