On November 15, 2018, the Agricultural Policy Research Center (APRC) presented the results of its “Study on Private Service Providers in the Organic Hazelnut Value Chain in Georgia” to stakeholders. The event was organized by HEKS-EPER South Caucasus, the ISET Policy Institute (ISET-PI), and PAKKA AG, a Swiss holding.

BACKGROUND

Hazelnuts have historically been one of the main crops in terms of economic value for Georgia as the country is located in the Black Sea coastal area, which has suitable soil and climate conditions for the growth of hazelnuts. In 2016, Georgia was among the top five hazelnut-producing countries in the world by production amount, with the rankings as follows: Turkey (56.5%), Italy (16.2%), the US (4.6%), Azerbaijan (4.6%), and Georgia (4.0%) (FAOSTAT, 2016). Hazelnuts are not only one of the most important crops in terms of Georgian exports, but also in terms of employment: approximately 107,000 households are involved in hazelnut production (Agricultural Census, Geostat, 2014)

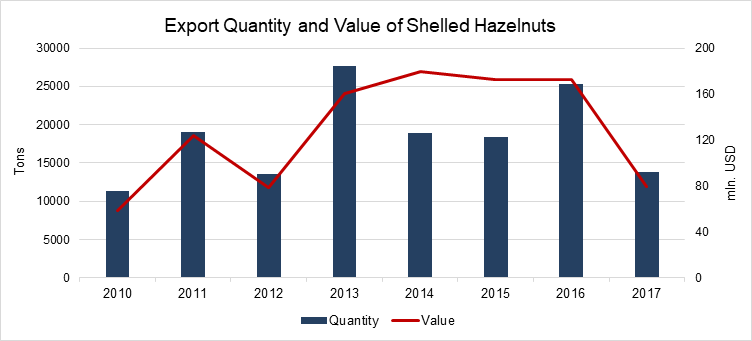

The hazelnut sector has received a substantial amount of attention from the central government. Georgia has been striving to foster hazelnut production and increase export to make it more competitive on international markets. However, 2017 was a very challenging year for the sector as hazelnut trees suffered from various fungal diseases due to unfavorable weather conditions. In addition, the Brown Marmorated Stink Bug (Halyamorpha halys) invasion subsequently worsened the situation in the sector, which was reflected in both the quality and quantity of hazelnut production. In 2017, the export price of Georgian hazelnuts on the global market was 5.73 USD/kg, which was 16% lower than in 2016. Ultimately, hazelnut exports dropped dramatically in both value and quantity compared to 2016. In 2017, the export value of hazelnuts accounted for 83.1 mln USD, 53.7% lower than the same figure the previous year (179.5 mln USD) (Geostat).

Figure 1: Export Quantity and Value of Shelled Hazelnuts

In order to fight against the Brown Marmorated Stink Bug (BMSB) and protect agricultural production, the Government of Georgia set a strategy for 2018 which consisted of four steps: an information campaign, a monitoring system, controlling measures against the BMSB, and research and development activities. The expected outcome of these measures was to decrease damage to agricultural production, including hazelnuts.

STUDY ON PRIVATE SERVICE PROVIDERS IN HAZELNUT VALUE CHAIN

It is widely perceived that the hazelnut value chain is well developed in Georgia. This process is demand-driven, and thus all the developments in the chain should trickle down to the farmer level. In order to draw a qualitative picture of the current situation and identify the specific needs of the hazelnut sector in the country, ISET-PI conducted research on private service providers in the hazelnut value chain during February-April, 2018.

The main purpose of the study was to analyze the current status of the development of organic and conventional hazelnut production. The study identified the structure of and relevant actors in the hazelnut value chain. The main emphasis was on service providers, such as laboratories providing soil and product analysis, seedling producers; husking, drying and pruning services; local providers of mechanization services; organic input (fertilizer and pesticide) producers/importers; warehousing and associated service providers; intermediary cooperatives; credit and insurance providers; extension service providers, including international donors; associations, governmental institutions, experts and agents of change including those from international/non-governmental organizations; as well as other authorities.

CONSTRAINTS TO HAZELNUT SECTOR DEVELOPMENT

The study revealed the main constraints for the hazelnut value chain:

● Low awareness – There is a low level of awareness regarding the role of different services in farming. Traditionally, farmers do not treat their soil with pesticides and fertilizers. They are not aware of the need to improve the physical, chemical, and biological health of their soils. Therefore, they do not value the role of laboratory services. For instance, roughly 90% of farmers interviewed did not do any soil analysis and they apply fertilizers and pesticides in approximate quantities. In addition, farmers lack the proper skills and knowledge of pruning practices.

● Lack of machinery services – Not every municipality is equipped with state mechanization centers. Private service providers who offer machinery services to farmers do not have enough equipment to meet demand. In addition, there is a lack of small scale machinery (e.g. drying and spraying facilities).

● Access to finance – The lack of access to finance is one of the main hindrances along the hazelnut value chain. On the one hand, farmers do not have enough financial resources to buy proper inputs for production; as agricultural production is associated with high risks, Micro Finance Institutions (MFIs) offer loans to farmers at very high interest rates. However, different service providers including laboratories and mechanization centers lack finances to develop their services by buying new technology.

● Lack of qualified workers – The lack of qualified agronomists appears to be one of the most problematic issues in Georgia’s hazelnut sector. In particular, farm supply stores are not equipped with qualified consultants who provide advice regarding the use of inputs. There are also insufficient numbers of qualified hired workers who can provide pruning services to farmers.

● Lack of trust – Farmers have very little trust in different services, service providers and other value chain actors. For instance, farmers do not trust the quality of inputs provided by shops. Farmers also lack trust in the processing companies who provide drying and storage services.

RECOMMENDATIONS

Given the systematic nature of constraints in the hazelnut value chain in Georgia, we have taken a holistic and systematic look at the hazelnut value chain and provide these recommendations for sector development:

Increase trust between value chain actors – In order to ensure synergy between the key actors in the hazelnut value chain, it is important to build trust along the whole chain. For instance, attaching qualified agronomists to each village might help farmers trust their recommendations and improve their farming practices. Regarding drying and storage centers, farmers will no longer have trust-related issues if service providers use mobile drying equipment and farmers are able to observe the process.

Value chain financing – Contract farming provides a potential solution to the problem of access to finance. Processing companies can play the role of facilitators in this process and should link the following actors: processing companies, farmers, farm supply stores/extension providers and MFIs. MFIs transfer loans to the farm store account, but the loan is issued under the name of a farmer. The shop/service provider is obliged to provide the farmer with the agreed-upon inputs, equipment, and services. The burden of risk should be divided between the processing company, the farm supply store, and the farmer. When the hazelnuts are sold, the processor returns the money (loan + interest) to the MFI. Linking different actors (for example those that were identified as focal points) and integrating different services can provide win-win outcomes for everyone in the chain.

Partnerships to build knowledge, skills and attitudes – Creating partnerships and strengthening the dual education system would help to create a pool of knowledgeable and skilled young farmers and agronomists that in turn would increase youth employment in hazelnut production. Without building knowledge, the organic hazelnut sector will continue the vicious cycle: farmers have a lack of knowledge and skills, which only shapes and encourages the wrong attitudes towards farming practices.

The hazelnut sector has gained attention and support not only from the government, but from donors and the private sector. The study itself presents a basis to shape interventions of the forthcoming ‘Phase II: Fairtrade & Organic Hazelnut Value Chain Development for Small Farmers in Western Georgia’ project, which is to be implemented by the Consortium (ELKANA, HEKS/EPER, ANKA and PAKKA) with the financial support of DANIDA. We hope that all these efforts and support will contribute to employing good agricultural practices in the hazelnut sector, production and, thus, Georgia will capitalize on opportunities to become more competitive on the international markets.

Comments