- Details

Economic reforms announced in the run-up to the parliamentary elections in October 2016 raised concerns about whether Georgia was departing from its path of prudent fiscal policy. A reform of the corporate profit tax and increased infrastructure investment were driving expectations of a 6% of GDP budget deficit in 2017, endangering Georgia’s macroeconomic stability and its reputation with investors.

After winning the elections, the “Georgian Dream” coalition has undertaken significant efforts towards keeping the budget deficit at bay. The deficit in 2017 is now expected to remain at around 4% of GDP and to decrease in the coming years. This was achieved by increasing excises on goods such as fuel, cars, tobacco and gas and by further savings in administration expenditures. Immediate worries about Georgia’s economic stability are hence allayed. At the same time it is important to monitor the economic and the fiscal effect of the new fiscal measures in the coming years.

- Details

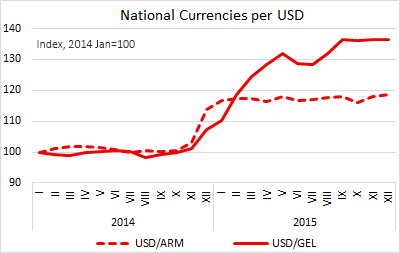

Both Georgia and Armenia have been subject to negative external economic shocks, particularly through remittances and exports, in 2014 and 2015, yet the macroeconomic adjustment of the countries appears to have been different. While the GDP growth of both countries remained relatively stable at around 3% in both years, the exchange rate of the Georgian Lari (GEL) depreciated by a 29% in 2014-2015 compared to 15% for the Armenian Dram (AMD). While the depreciation of the AMD was initially quicker than that of the GEL, the GEL depreciation lasted much longer into 2015.

Comparing the external shocks faced by the economies of Armenia and Georgia, it appears that Armenia was hit earlier, with remittances and FDI clearly dropping off stronger in the end of 2014 than in Georgia. However, Georgia was subject to a much larger and prolonged fall in exports – a 6% of GDP decrease in Georgia compared to 1.7% of GDP in Armenia in 2015. Also, the reaction of imports to reduced income and lower exchange rates appears much quicker in Armenia, partially explaining why the exchange rate may have behaved more stable in 2015.

- Details

Central banks are often surrounded by an aura of mystique and the common man on the street seems to have very little understanding not only of what, why, and how exactly a central bank does, but most importantly of how much a central bank actually can do. It is commonly believed that the job of a central bank is to print money, which sounds rather trivial. Yet, at the same time, it is often believed that a central bank can effortlessly push an economy in different directions, and that it controls various powerful economic variables – interest rates, exchange rates, inflation, unemployment, and growth – that affect our everyday lives.

Significant changes are envisioned for the National Bank of Georgia as the new government and the parliament take office. The latest proposal put forward by the Georgian government is to move towards an inflation targeting regime, a framework practiced by several central banks around the world (New Zealand, Canada, Euro area, U.K., Sweden, Australia, Iceland) and also being currently put in place in several transitional and developing countries.