- Details

• The lari depreciation caused a significant decrease in sale and rental prices in dollar terms.

• Rental prices slightly increased in August and September before the start of the new academic year.

• The commercial market turned out to be more resistent to the effects of currency depreciation.

The index slightly recovered in monthly terms over August and September, but the annual changes still remained negative (-4.5% and -4.7% respectively). Download the full report.

- Details

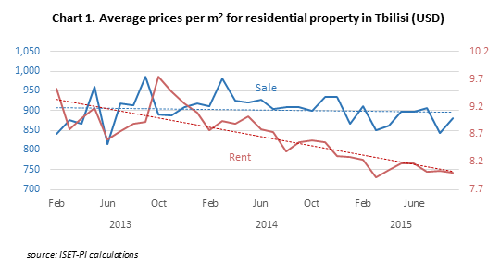

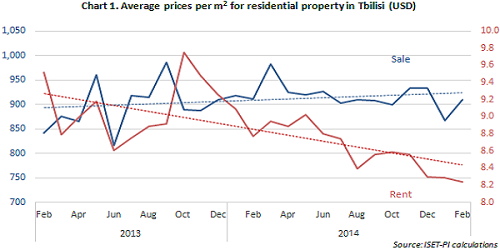

• The lari depreciation caused a substantial decrease in USD prices of real estate. Average rental prices of residential property reached their historical minimum in March 2015.

• Property sellers are trying to compensate for the price decline by offering better, more expensive housing for sale.

• The lari price increase of rental properties has driven demand away from the central districts of Tbilisi to the nearby suburbs.

Some interesting phenomena can be observed on the residential property Tbilisi market in the period March-May 2015. First, average rental prices continued to follow a downward trajectory. In particular, in March average rental rates reached a historical low of 7.92 USD per m2. At the same time, average sale prices declined to 850.3 USD per m2 in March. Download the full report

- Details

• The lari depreciation has started to affect real estate market prices in Tbilisi.

• The average rental price for residential property has continued to fall, reaching a new historical minimum in February 2015.

• In January 2015, for the first time since the beginning of the sample, Old Tbilisi was not the most expensive district on the rental market.

In January and February 2015, there was no significant change in the rental and sale prices of residential property, but the price on both markets remained below their long run trends. Average rental prices declined in both months, reaching a new historical minimum of 8.23 USD per m2 in February 2015. Likewise, in the first two months of 2015 the residential rental price index decreased by 6.2% and 2.9% respectively, compared to the same period in 2014. Moreover, average sale prices declined sharply to 867.6 USD per m2 in January (the lowest level since June 2013), recovering only slightly in February. Download the full report