In August 2018, Georgian power plants generated 985 mln. KWh of electricity (a 5% decrease in total generation, compared to the previous year and a 22% decrease with respect to July 2018), while consumption of electricity on the local market was 1,049 mln. kWh (+1% compared to August 2017, and -4% with respect to July 2018).

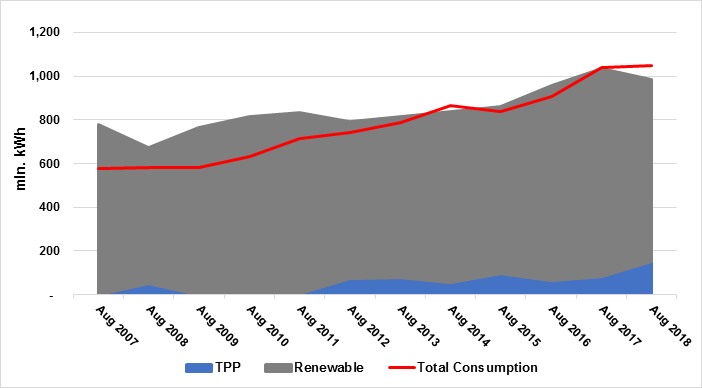

Consumption to exceed generation by 64 mln, which is 6% of total consumption and 7% of the amount generated. As it can be seen in Figure 1, the emergence of a generation-consumption gap was not totally unexpected. Not only it did occur two times in both 2014 and 2017, but the speed at which consumption has been growing since 2009 has clearly been outpacing that of generation, with an acceleration between 2015 and 2017. Still, what occurred this year stands out because of the sudden widening of the gap, the largest gap experienced in the month of August over the last 12 years. Will such a gap persist in the future? Is Georgia heading towards a future in which it will need to import significant amounts of electricity during the summer months as well as the winter? This will crucially depend on whether the causes of the recent drop in generation were just temporary or are, instead, here to stay.

Figure 1. Electricity Consumption and Generation (mln. kWh)

The decrease in generation on a yearly basis occurred in hydropower and wind power generation. Generation from hydropower plants (HPPs) declined by 12% compared to August 2017, while generation from wind power plants (WPPs) declined by 10%. The fall in generation from renewables was partially offset by thermal power plants (TPPs) stepping up their generation to a level 80% higher than in August 2017.

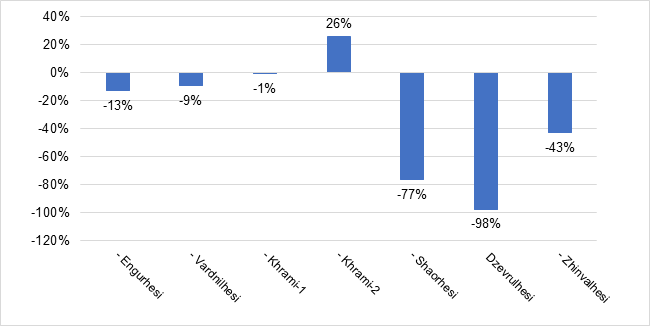

The reduction of generation from HPPs mainly comes from the decline experienced by regulatory and seasonal HPPs (Figures 2 and 3). In absolute terms, due to their size, the largest impact came from the decline in Enguri and Vardnili’s generation (which historically produced between 50% and 60% of total generation). The generation of Enguri in August 2018 decreased by 13% compared to August 2017, while the generation from Vardnili declined by 9% over the same period. Other regulatory HPPs, however, showed much larger declines in relative terms, with Dzevrulhesi producing almost no electricity (-98% with respect to August 2017) and generation from Shaorhesi and Zhinvalhesi HPPs down respectively 77% and 43%.

Figure 2. Growth of electricity generation by regulatory HPPs by August 2018 compared to August 2017

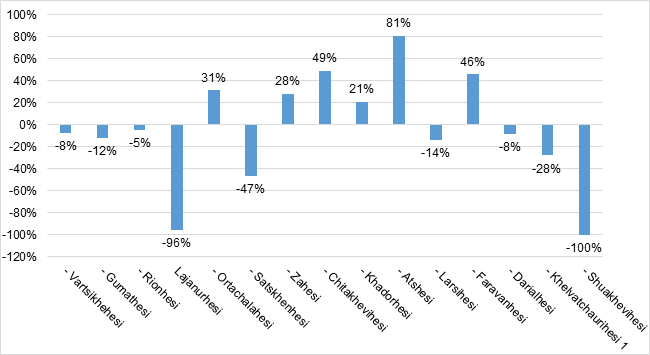

At the same time, most seasonal HPPs also experienced a decline in electricity generation, the largest being those experienced by Lajanurhesi (-96%) and Shuakhevihesi (no generation at all).

Figure 3. Growth of electricity generation by seasonal HPPs

The decline in generation from HPPs and the increase in generation from TPPs caused the share of electricity produced by renewable sources to decrease to 85% of total generation (835 mln kWh), while thermal power generation increased to cover 15% of total generation (150 mln. kWh).

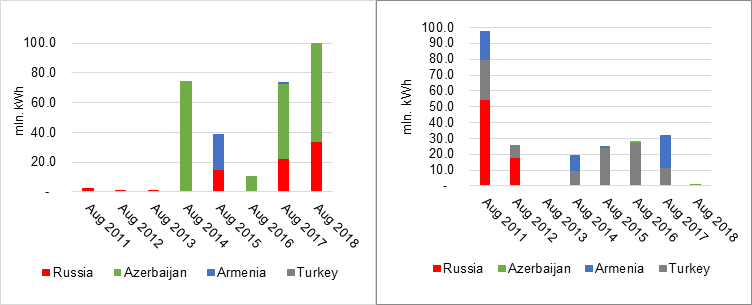

The remaining part of the gap was covered by imports. In August 2018, Georgia imported 99.6 mln. kWh of electricity (4.6¢ - 11.7 tetri), with a 37% increase with respect to August 2017. Two thirds of this electricity was imported from Azerbaijan, while the remaining 34% was imported from Russia (Figure 4). Not surprisingly, in August 2018, Georgian exports collapsed down to a mere 0.017 mln kWh of electricity (5.9¢ - 14.98 tetri). 12% of exports were exported to Russia (0.002 mln kWh) and 88% to Azerbaijan (0.015 mln kWh) (see Figure 5).

Figure 4. Imports (mln. kWh) Figure 5. Exports (mln. kWh)

The increase in domestic consumption (1% higher than in August 2017) had little to do with the increase in the generation-consumption gap. The gap arose solely because of the drop in generation coming from HPPs and WPPs.

We contacted several HPP operators to better understand the reasons of this development. The operators of big regulatory HPPs suggested that the most relevant cause for the decrease in generation is reduced water inflows. The reduction in electricity generation among the other HPPs might be instead partially due to technical issues, even though we were not given any detailed explanation. As for WPPs, the operators suggested that the decrease in generation is purely caused by a less windy period in August 2018 compared to the last year. Consequently, adverse climatological conditions seem to be the main determinants of the widening gap between electricity consumption and electricity provision.

By examining historical data, we can expect the generation from HPPs generation to decline further as we enter the winter season. As a consequence, TPPs generation and imports will increase to close the gap. The extent of the decline in HPP generation will, again, depend from the climatological conditions. If the recent trend continues, we might be facing record numbers of imports in the coming months.

It is too early to say whether the August gap addressed here will remain a sporadic case or is instead the first sign of a progressive deterioration in the electricity balance of the country also in summer months. It is certainly important, however, to continue monitoring closely both generation and consumption trends and to be prepared to develop and implement policies to ensure the country’s energy security, in case the dependence from imports continues to grow.

Comments