BACKGROUND

Agricultural production is associated with a variety of risks, including market, institutional, and production risks. An important production factor in agriculture is the weather. Its uncontrollable nature makes weather risk the prevailing risk to agricultural production. Farmers have various informal and formal means of transferring and mitigating these risks. Informal means include savings, diversification, off-farm activities, etc. The most common formal means of risk mitigation is insurance. Insurance is a contract that transfers the risk of financial loss from an individual or business to an insurance company. It works on the principle of large numbers: the insurance company collects small amounts of money (premiums) from its clients and pools that money together to pay for losses. In that way, the risk is transferred and distributed across space and time, allowing the insurance company to pay indemnities because it has reserves (the premiums paid by many farmers) from good years or from farmers in other areas.

The absence of a well-functioning agricultural insurance market negatively affects the country’s development perspectives at different levels. In the absence of agricultural insurance, natural disasters (hail, strong winds, floods, frost, and droughts) can cause significant crop losses for farms, increasing the financial vulnerability of farm households and, more generally, increasing uncertainty for all agents engaged in agricultural activities. In this context, investments that might increase agricultural productivity are more likely to be delayed, with negative consequences for income growth.

CURRENT SITUATION

In 2014, the Government of Georgia initiated the Agricultural Crop Insurance (Agroinsurance) Project. The aim of the program is to support the development of the agricultural insurance market to minimize production risks and thus stabilize farmers’ income, encourage investment, and increase agricultural production.

Within this project, insurance packages cover losses caused by weather-related disasters such as hail, flooding, and storms, as well as by autumn frost (though only for citrus). Farmers are granted the opportunity to insure a maximum of 5 hectares of land of crops other than grains. For grain, insurance is available for a maximum of 30 hectares of land. In the case of agricultural cooperatives, the maximum insured sum is 50, 000 GEL but the area of insured land is not limited.

The program is subsidized by the state, and eight insurance companies participate in the program. The Government of Georgia provides the following subsidies on insurance premiums:

• 50% of the value for vineyard insurance

• 70% of the value for insurance of all other crops

Since the beginning of the program, 49.3 thousand farmers (unique beneficiaries) have purchased insurance. Demand was particularly high in 2014 and dropped afterwards due to the reduction of the state subsidy from 90% to 70% (Figure 1). While in 2016 and 2017 there was an increasing trend in the number of insured farmers, in 2018 the number of unique beneficiaries declined again due to the requirement that the insured land plot be registered in the public registry. While it was necessary to link this program (and any other government support) to land registration, it hindered the demand for agroinsurance, as most agricultural lands are still not registered. According to recent data from the Public Registry, only 45% of land in Georgia is registered, although many attempts at registration have been made over the last three decades (see more in our previous publication).

Figure 1. Number of Unique Beneficiaries (ths.)

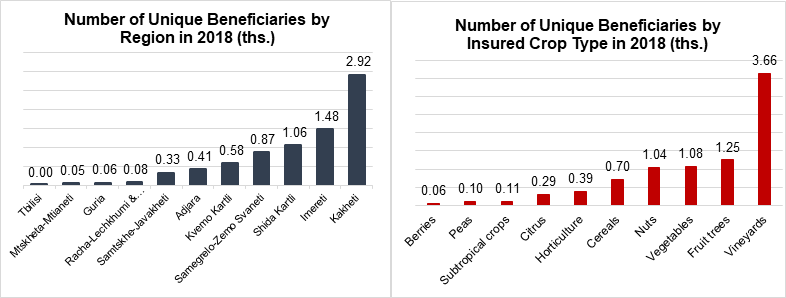

In 2018, the greatest number of farmers was insured in Kakheti (2.92 ths.) and most farmers insured vineyards (3.66 ths.). Historically, the program has had the highest number of insured farmers from Adjara, and citrus has been the top crop insured. This is not surprising, given that citrus is the leading crop in Adjara.

Figure 2. Number of Unique Beneficiaries by Region in 2018, Figure 3. Number of Unique Beneficiaries by Insured Crop Type in 2018

In summary, under the Agroinsurance program in 2014-2018, 81,453 insurance policies were issued country-wide; 71,413 hectares (cumulative) of land were insured with insurance around 551 mln. GEL, and the Agency’s subsidies added up to more than 33 mln. GEL. In 2014-2018, insurance companies paid more than 35 mln. GEL in compensation for damages. In 2015, ISET Policy Institute conducted the “Regulatory Impact Assessment on Crop Insurance Reform in Georgia”. The study assumed that the total area of insurable land in Georgia was 397,943 hectares. To compare, the average area of insured land is only 14,283 hectares a year, which accounts for only 3.6% of the potential insurable land. Despite the government’s efforts, the penetration rate of insurance is still very low and we observe a decrease in the number of unique beneficiaries (as indicated in figure 1).

CHALLENGES REGARDING AGRICULTURAL INSURANCE IN GEORGIA

There are several challenges that prevent the development of an insurance market in the agricultural sector in Georgia:

Low willingness to subscribe: There is a low insurance culture among Georgian farmers as they lack awareness of and experience with agricultural insurance, making them reluctant to insure their production. They do not like the idea of paying money “when nothing happens” (when no losses in agricultural production are incurred). In addition, farmers do not trust insurance companies as they do not fully understand how insurance companies will behave in case of a negative event. This uncertainty and distrust reduces farmers’ willingness to subscribe.

Lack of qualified agents in the insurance sector: There is a lack of qualified insurance sales agents, as well as a lack of offices (branches) and information sources about agroinsurance. The relatively lower quality of services (sales agents and loss adjusters) due to the current scarcity of investments in this area, potentially hampers the development of the insurance market.

Lack of Agrometeorology data: One important aspect of premium rates is the expected loss cost. To precisely calculate the expected loss cost, it is necessary to have accurate historical data on catastrophic events. However, such data are rarely available in Georgia, forcing private insurers to add a so-called ambiguity load to the expected loss cost in their premium calculations and forecasting. The development of an agricultural insurance market in Georgia is very much constrained by the lack of yield data, as well as the lack of information on the individual risk profiles of farmers. All this, paired with high administration costs (too many small farmers), leads to high insurance premiums and less affordable insurance products.

RECOMMENDATIONS

The agricultural insurance market faces several challenges on both the demand and supply sides, making government intervention necessary. The government can support the development of agricultural insurance programs in various ways that go well beyond subsidizing premiums. The government can assist by:

• Promoting the development of dedicated data collection and management systems, which are a precondition for feasible implementation of insurance programs, such as area yield schemes;

• Supporting the design and development of appropriate insurance solutions;

• Reaching out to farmers and other stakeholders to increase awareness;

• Building the capacity of their employees who specialize in agricultural insurance;

• Supporting research on and development of innovative agricultural insurance products and services to reach small farmers and expand the penetration rate. Agroinsurance products should be tailored to the targeted farmers by region and crop;

• Supporting the establishment of appropriate public and private structures. Properly structured PPPs can generate synergies that allow each component to contribute to the development and formation of more effective and efficient interventions in the insurance market;

• Exploring the usefulness of other types of subsidies for insurance products (e.g. tax exemptions). Tax exemptions are considered a direct subsidy for agroinsurance products. By conducting a cost-benefit analysis, the government can assess the merit of reducing or exempting tax on agroinsurance. Therefore, the effect of tax exemption may be marginal on the state budget, however, the potential impact of supporting agroinsurance through tax exemptions could be significant (Oxfam, 2018);

• Creating a reinsurance mechanism, which is a risk-spreading mechanism, particularly important in managing financial exposure to covariate natural hazard risks such as drought in agricultural insurance. Reinsurers have expertise in agricultural insurance products and provide risk-sharing through reinsurance. They can support insurers with actuarial pricing of risks and may also provide technical support to programs;

• Introducing livestock insurance - The current agricultural insurance program only covers agricultural crops. However, in 2018 the loss of bovine animals was 55,800 head. The corresponding number of pigs was 76,100, and sheep and goats 96,200. Considering the number of livestock as of the end of 2018, the losses of livestock are high.

Moreover, the long-term commitment of all stakeholders is crucial for the establishment of a well-functioning agricultural insurance market. The government has to take the lead in this process and engage all other parties, in particular, insurance companies.

Comments