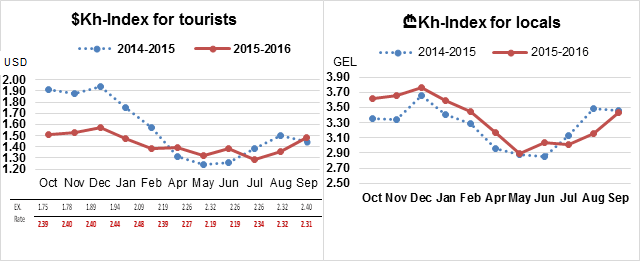

One glance at the ₾Khachapuri Index chart (for locals) tells the whole story of Georgian agriculture. Left to fend for themselves during the cold winter months, Georgian cows produce very little milk, sending dairy prices through the roof. Conversely, milk production peaks with the arrival of sunny weather and green fodders in early spring, leading to a collapse of milk prices. In the absence of large-scale industrial milk production (that does not depend as much on climate and weather conditions), the roller coaster image repeats itself, year in and year out.

A somewhat different picture emerges if we recalculate the Khachapuri Index in US$.

The roller coaster image is very easy to discern in 2014-15 (dashed blue line). Peak-to-trough (December 2014 to May 2015), the $Kh-Index fell a solid 36% as compared to 28% for its Georgian ₾ equivalent. The fall in $Kh-Index was so precipitous because in the first half of 2015 the ₾/$ exchange rate dynamics reinforced the seasonal fluctuations in the price of Imeretian cheese and other seasonal ingredients. In other words, not only did the Khachapuri ingredients become cheaper after January 2015, but also the Georgian currency lost in value, falling from about 1.80 to 2.30 ₾/$ in a matter of 6-7 months. Thus, by April 2015, Georgia had become an extremely cheap destination for foreign tourists; in May 2015, the $Khachapuri Index hit an all-time low of $1.24!

Interestingly enough, the roller coaster image disappeared almost completely in the second half of 2015 and in 2016 (solid red line) since lari and dairy prices happened to move in the opposite direction, cancelling each other’s influence and producing a line that is much flatter than the norm. Thus, when demand for traditional Georgian delicacies went up with the start of the high tourism season (in June-July 2015), the lari went down due to external developments in the global currency markets. As a result, the $Kh-Index did not increase as much as its Georgian ₾ equivalent. Similarly, the Lari started appreciating in spring 2016 (reaching a local maximum of 2.19 ₾/$ in June), at exactly the time when seasonal factors normally bring ₾Kh-Index to its annual minimum. Overall, peak-to-trough, the $Kh-index fell only 21%, as compared with 30% in local currency.

* * *

The most important takeaway from the $Kh-Index story is that, in the absence of significant price inflation, a devaluated national currency strengthened Georgia’s position as a competitive destination for international tourism (at least as far as prices are concerned). The prices of Georgian goods may go up and down due to seasonal factors (in both lari and US$), but on average we have become much cheaper for foreign consumers of our tourism services and goods. This might have been an important factor behind the spectacular increase in the number of international arrivals that Georgia has seen in 2016.

See our article usage guidelines

Comments