As any other labor-exporting country, Georgia faces both the costs and benefits of migration. The main costs include human capital flight – the so-called “brain drain” – and the distortion of the age and gender structure of the population.

The benefits include alleviating social pressures caused by high unemployment rates, the international experience and skills returning migrants bring back to their home countries, and, very importantly, the remittances, or money transfers, that emigrants make to their families. For many households in Georgia these money transfers represent the only means of financing personal consumption expenditures, education and health care.

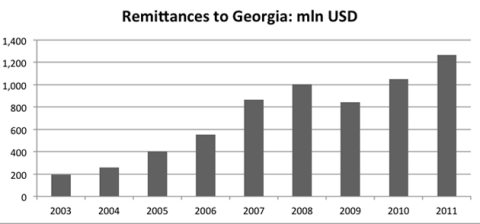

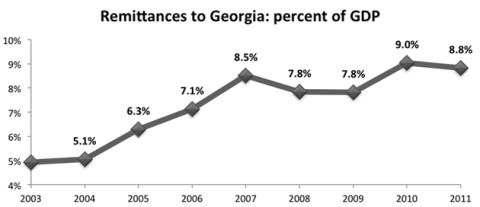

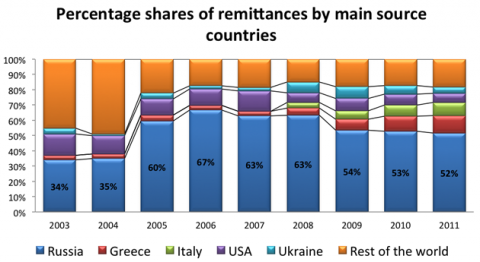

Remittance inflows to Georgia are as important for the whole economy as they are for the recipient households. Growing steadily since 2003, in 2011 remittances amounted to almost $1.3 billion, which is about 8.8% of Georgia’s total GDP. In addition to this, as the bulk of remittance inflows are denominated in US dollars, they represent a major source of foreign exchange and thus are significant in financing Georgia’s trade deficit (i.e. remittances account for a larger share of trade deficits than FDI!). Moreover, these money transfers are a more stable source of foreign exchange than other types of foreign capital inflows, including FDI. Importantly for the stability of remittance inflows, Georgia’s “portfolio” of remitting countries is becoming more diversified over time. While still accounting for more than a half of total remittances to Georgia, Russia’s share is on a steady decline from the peak of 67% in 2006 to 52% in 2011.

There are two different motivations encouraging an emigrant to send money to his home country: altruism and investment. Altruistically motivated emigrants might send money to ease their family’s economic burden. Such individuals would be expected to send more money when their families find themselves in economic hardship. On the other hand, emigrants with investment interests might want to send money back to their families to do things such as deposit money in a local bank account or invest in real estate or a business on their behalf. In this instance, one may expect a greater amount of remittances at a time when investment opportunities in Georgia are more favorable compared to those in remittance-source countries. Of course, for many emigrants the two motives might hold equal importance.

Both altruistic and investment motives shape Georgian emigrants’ behavior and affect their decisions to remit. On the one hand, they seek to compensate for relatively unfavorable economic conditions in Georgia and send more money when the real GDP growth gap between the remittance-source countries and Georgia widens. On the other hand, they tend to take advantage of favorable investment opportunities in Georgia, whenever they are available. Georgian emigrants transfer more money when the lari depreciates, taking advantage of the low price of domestic assets in terms of foreign currency. Likewise, when the lari appreciates remitters try to postpone their money transfers until a period when the lari has depreciated.

An implication of my findings is that remittances serve as a good automatic stabilizer of the exchange rate. In the event of a large depreciation of the lari (which, according to my study, stimulate remittances), an increase in remittance inflows may, to some extent, push the domestic currency back to its previous value by stimulating demand for it.

As long as Georgian emigrants keep being altruistic, as they seem to be now, or provided that investment motives continue to be important in their decisions, Georgia will continue enjoying large remittance inflows. This prediction is of course conditional on the number of Georgian emigrants abroad remaining at about the same level they do now.

This is likely to be the case until such a time as Georgia can create the jobs for its Western-educated and highly-skilled workers to come back. This, however, is yet a topic deserving more detailed analysis…

Comments

"brain drain" and remittances are weekly correlated for Georgia

Can you explain your point? Is your emphasis on "weekly" or "correlated"?

If I am not mistaken, the study we did for the GDN found that there were [almost] no remittances for investment purposes. It all went into current expenditures and the big ticket items were things like weddings and funerals.

The interesting thing is why there was decline in the amount of remittances in 2009, was it due to the global financial crisis? And also, is the relationship between remittances and exchange rate a finding of your research or is that just an observation of the trends?

Temo, the decline in remittance inflows in 2009 was indeed largely due to the global financial crisis. According to our findings, about 2/3 of a 16%-contraction in remittances in 2009 was solely due to the crisis. As regards to exchange rate, yes, this is again an empirical finding of our study.

Robert, we actually find that an increase in interest rate differential between Georgia and the source countries (which in fact proxies investment opportunities in Georgia) does not have statistically significant effect on remittances, indicating that investment motives may not play any role in the Georgian emigrants decisions to remit. On the other hand, however, we find a positive impact of the lari's depreciation on remittance inflows, which is a little bit puzzling (given that we could don't document the presence of investment motives in relation with interest rate differentials and also it is against the common finding in the related literature that emigrants tend to compensate for changes in the exchange rate). So, one possible explanation of this finding could be that the remitters actually respond to favorable investment opportunities in Georgia (in this case as reflected in lower prices of domestic assets in terms of foreign currency). Any other interpretations are more than welcome.