Benjamin Franklin once said, “In this world, nothing can be said to be certain, except death and taxes.” Yet we have a tax that could prevent hundreds of millions of premature deaths. It is time to use it more effectively.

-Prabhat Jha

It is a truth universally acknowledged, that cigarettes are bad for human health. Yet, whenever the government tries to regulate consumption of cigarettes by increasing their price, it gets a very mixed reaction from the public. Some people (mostly non-smokers) welcome these policies, while others accuse the government of being greedy and proclaim the policies ineffective. Who is right and who is wrong in this debate? Let’s take a closer look at the facts.

BACKGROUND

In January 1, 2017 Georgian tobacco smokers faced the fifth tax hike on cigarettes during the last five years. This time, the excise tax was increased by 60 tetri per pack of filtered and by 30 tetri per pack of non-filtered cigarettes.

By definition, an excise tax is an indirect tax charged on the sale of certain goods, which usually have a high social cost. This means that a consumer does not directly pay the tax, but the burden initially falls on the producer, who, by including it in the product's price, passes the tax on to the consumer. Typical examples of excise duties are taxes on alcohol, cigarettes, drugs, fuels and gambling. In addition to these, even candies, soft drinks and other products containing sugar are objects for excise tax in some countries.

In general, excise tax on cigarettes comprises two components: a specific component - expressed as a fixed amount per cigarettes’ pack; and an ad valorem component – expressed as a percentage of product’s retail price. In Georgia, the first increase of excise tax on cigarettes happened in September 2013; from July 2015, ad valorem component was added - it constituted 5% of the retail price (10% from 2016). From the beginning of 2017, a minimum of 187 tetri (specific + ad valorem component) is a pure excise tax component in the price of filtered cigarettes.

Table 1: Excise tax on Cigarettes

Excise Tax |

Cigarettes |

2011 |

2012 |

2013 |

Sep,

|

2014 |

2015 |

July,

|

2016 |

2017 |

| Specific Component | Filtered | 60 | 60 | 60 | 75 | 75 | 90 | 90 | 110 | 170 |

| Non-filtered | 15 | 15 | 15 | 20 | 20 | 25 | 25 | 30 | 60 | |

| Ad valorem Component | Filtered | 0% | 0% | 0% | 0% | 0% | 0% | 5% | 10% | 10% |

| Non-filtered | 0% | 0% | 0% | 0% | 0% | 0% | 5% | 10% | 10% |

Source: Tax Code of Georgia

WHY DID GEORGIA INCREASE EXCISE TAX?

There are a number of reasons behind the recent hike in excise tax on cigarettes. First, according to government representatives, the main aim is to improve public health outcomes by affecting consumption of cigarettes through higher prices. Second, Georgia is obliged to increase control on tobacco consumption in accordance with international arrangements1. Third, excise tax is simply a good source (maybe the only way in Georgia) for easily increasing budget tax revenues2.

Can the government really kill two birds with one stone – i.e. increase the health of the nation AND fill the budget coffers with extra money? Let’s look at how well the excise tax has been helping in both areas so far.

BUDGET

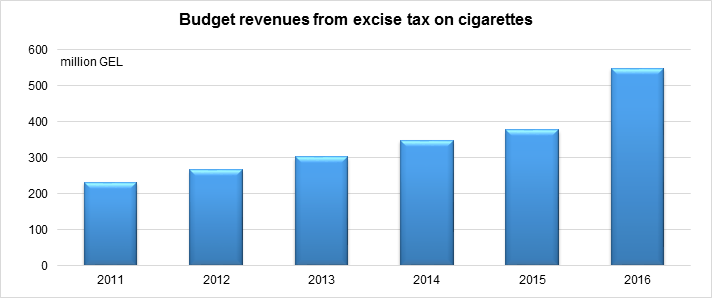

According to budget plan 2017, increased excise tax rates on fuels, cars, and cigarettes will together accumulate additional 597 million GEL tax receipts, of which about 200 million GEL will be collected from cigarettes. This ambitious projection is pretty realistic considering previous dynamics of tax receipts – from 232 million GEL in 2011 to 549 million GEL in 2016 (see the figure below).

CONSUMPTION

We can make a judgement about the consumption of cigarettes based on the quantity of excise stamps sold by the government (typically, one excise stamp translates into a pack of cigarettes sold).

Looking at the quantity of stamps sold between 2015 and 2016 we can clearly see a reduction in consumption of imported filtered cigarettes (the most expensive group on the market). The quantity of domestic filtered cigarettes has also declined. However, the amount of domestic non-filtered cigarettes increased, despite the substantial, in percentage terms, price hike (see the figure below)3.

Clearly some smokers reacted to the price hike by substituting away from more expensive filtered (domestic and foreign) cigarettes towards cheaper non-filtered domestic ones.

This is not good news for the government, given that non-filtered cigarettes are also lower quality and more dangerous for health.

Moreover, despite the fact that people started consuming less foreign cigarettes so far we have not seen a reduction in the value of cigarette imports. On the contrary, import values increased from 90.2 million USD in 2012 to 101.4 million USD in 2016 (without considering the exchange rate effect).

Yet, an increase in cigarette price may have a silver lining for domestic producers. The export of cigarettes sharply increased from 5 thousand USD in 2012 to 10.4 million USD in 2016.

This may indicate that higher production costs are forcing domestic producers to compete in a higher price range and improve the quality of their products. The positive side effect of this is the increased export potential of locally made cigarettes.

DOES CIGARETTE PRICE AFFECT BEHAVIOR?

It is interesting to look at the literature that studies the effects of the excise taxes on smoking behavior. One paper “Effects of Tobacco Taxation and Pricing on Smoking Behavior in High Risk Populations: A Knowledge Synthesis” analyzes 108 existing studies on the linkage between taxation and smoking behavior for different subgroups of population. The authors concluded that raising cigarette prices through increased taxes is an effective policy measure for youth, which is two to three times more price-responsive than the general population. They conclude that increase prices reduce smoking participation, consumption of cigarettes, and smoking initiation among youth.

Less pronounced but still strong effects are observed in the case of young adults and persons with low socioeconomic status. However, the main concern with lower-income individuals is about fairness of excise tax. Some literature suggests that cigarette tax is regressive tax on the poor. In other words, the share of money paid on excise tax in their disposable income is much higher than the same indicator for high-income persons. In addition, studies propose that because people of lower socioeconomic status have higher smoking rates, they pay more tobacco tax per capita than those with higher incomes.

In other words, smoking addiction may be contributing to a vicious cycle that keeps poor people in poverty. This could be a problem for Georgia as well.

IS THE GOVERNMENT KILLING TWO BIRDS WITH ONE STONE?

The answer to our initial question appears to be yes:

• The government of Georgia has successfully reduced consumption of cigarettes - the total number of excise stamps granted by Ministry of Finance reduced by 11.8% in 2016 compared to 2012, which is a 62 million cigarette’s pack reduction of consumption. That being said, the effect on health may not be clear, since there is some substitution from higher quality cigarettes to lower quality ones.

• The government tax receipts from cigarette excise tax increased significantly (from 232 million GEL in 2011 to 549 million GEL in 2016).

Yet, before celebrating victory, the government should keep in mind several things: First, increased prices have to be accompanied by strategies to mitigate any adverse consequences on low socioeconomic status population and heavy and/or long-term smokers. Second, more aggressive control of contraband cigarettes is needed to make tobacco taxation more effective in the future. Third, the government should keep in mind that once the price hike reaches a certain level, the tax revenues from cigarettes may start to drop.

The last point will be a real test of government’s resolve to keep the pressure on cigarette prices. And for the sake of society’s health, let us hope that the government’s actions will echo the sentiment of the former New York City mayor Michael Bloomberg, who once said “If it were totally up to me, I would raise the cigarette tax so high the revenues from it would go to zero.”

1 Association Agreement obliges Georgia to implement the 2011/64/EU directive, which means that in the future excise tax must constitute not less than 60% of weighted average retail price and not less than 1.8 euro (about 5 lari) per pack of cigarettes. Therefore, a more dramatic rise in excise tax is expected in the upcoming years.

2 Since 2014, according to Economic Liberty Act, introduction of new taxes or increase of the tax rates (except the excise tax) is possible only based on the affirmative vote in a nationwide referendum. Consequently, excise tax is the only fiscal instrument left in government’s hands to increase tax revenues.

3 Based on available data for Georgia, an increase in the tax rate is almost fully translated into the final retail prices of cigarettes. The statistics suggest that excise taxes directly and immediately cause an increase in cigarette prices - since January 2011 prices of non-filtered and filtered domestic cigarettes rose by 112% and 92% respectively, while imported filtered cigarettes rose in prices by 69%. In value terms, the price of expensive cigarettes (which are supposed to be better quality than cheaper ones) increased more than cheaper ones due to ad valorem component.

Comments