Summer is a good time for traveling to the sea, but now I want you to join me in the journey in time. A memory from my childhood in the early 2000s was the discussion among people about the choice between “Khrushovka” and “Chekhuri.” Households were buying flats and making investments in real estate. It is difficult to explore the real reasons why people prefer real estate over other types of investments, but the some of the standard arguments which I was hearing were the following: “if something happens it is still a real estate,” “at least I will have a shelter,” “there is no other alternative,” “my son will get married soon,” and many others. Honestly, I do not know what was the argument behind the decision my uncle made 15 years ago when he bought a flat with his saved money. But I know for sure that during this period he was earning monthly rental income and eventually he sold out his flat in a lucrative deal.

To go back to today’s reality, a more or less similar situation is observed, but instead of choosing between “Khrushovka” and “Chekhuri,” the choice is between development companies and districts.. So, investment in real estate still considered to be a sound type of investment, and all these details are just a matter of taste.

Hope the journey in time was informative, but the real reasons why people invest in real estate instead of other types of investment still needs further elaboration. There are several arguments as to why investing in real estate can be preferable. One is that investing in real estate can be much easier to understand than complex investments. The underlying idea is that real estate involves the purchase of physical property and most people are familiar with real estate to some degree. The other more prominent argument is that real estate is a hedge against inflation. Real estate reacts proportionately to inflation. As inflation goes up, housing values and rents go up as well. This corresponds to my uncle’s example. 15 years ago in the nominal term, the price of a standard flat in Tbilisi was about six to seven times lower than what it would cost today, but at the same time, prices in general and on real estate have gone up as well. Thus, buying a flat 15 years ago at a lower price and selling it today at a higher price keeps purchasing power relatively stable.

Together with above-mentioned arguments, there are still many other factors affecting household investment decisions. Most importantly, real estate is not a standard investment product; it is also a significant part of household consumption. Real estate can be easily transformed from an investment product to a consumption good, or vice versa. As an investment product, return on real estate plays an important role in this process.

ISET Policy Institute regularly publishes a quarterly report about the real estate market in Georgia. The report covers important indicators of the real estate market and gives answers to many interesting questions, such as how many real estate sales transactions happened in that quarter, which regions are more active in terms of sales transactions, how prices on commercial and residential property change over time, which districts of Tbilisi are the most expensive and which ones are the cheapest, and so on. The information about rental and sales prices can be used to calculate return on real estate investment.

Return on real estate=((Average rental price)*12)/(Average sale price)

It should be kept in mind that in this blog, we are observing the rental and sale prices on residential properties only in Tbilisi. On its own, the Tbilisi real estate market is almost 40% of the whole real estate market in Georgia.

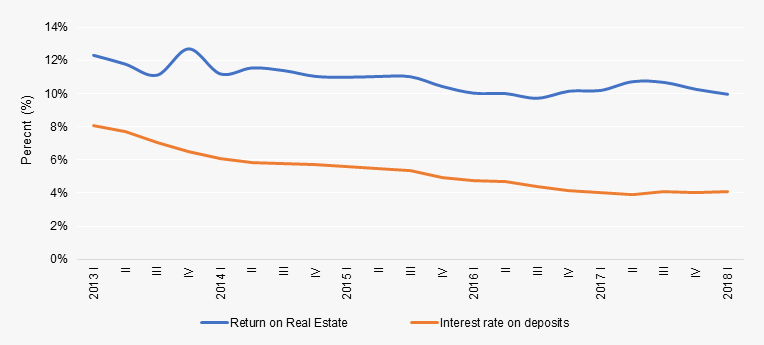

Graph #1. Return on real estate and deposits interest rate

Graph #1 shows that overall, the return on real estate, as well as the interest rate on deposits, have been on a downward trend, but more importantly, return on real estate is always higher than deposit interest rates. During the last five years, the average gap between these two rates was 5.5% in favor of return on real estate. This means that on average, the return on real estate generates two times more return compared to fixed-term deposits. While investing in real estate provides high returns, it is also characterized by some limitations, such as lower liquidity and higher transaction and maintenance costs.

The other special characteristics of real estate is that it is a fixed/non-movable asset. This means that the location of the real estate matters, especially when we treat real estate as an investment. Graph #2 compares the returns on real estate in different districts. Investing in real estate is the most profitable in Isani. This means that in Isani, you can earn relatively more from renting your apartment. Krtsanisi and Nadzaladevi also provide more than the average return in real estate investment. The least profitable investment in real estate was recorded in Saburtalo. This is mostly due to the relatively high sales prices in Saburtalo. In terms of sales prices, Saburtalo ranked as the third most expensive district, after Mtatsminda and Vake. It should be mentioned as well that in 2016, Saburtalo was still placed last for real estate returns. In 2016, for Saburtalo the return on real estate was even lower 9.2%. But on the other hand, we observe that there is not significant volatility in returns across districts. This means that return on investment in real estate is more or less the same in different districts.

Graph #2. Return on real estate by district, 2017

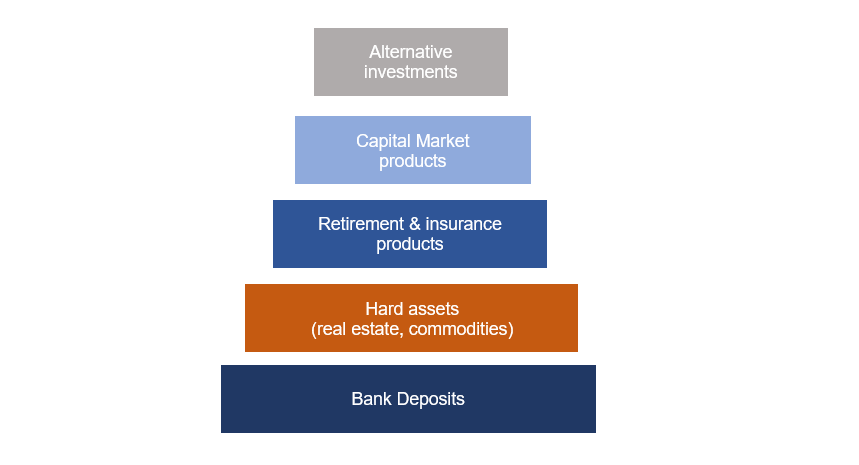

The profitability of investing in real estate has already been discussed, but as we all know real estate is not the only option. The World Economic Forum (WEF) provides a hierarchy of capital savings/investment and provides information on how saving behavior may differ in various stages.

Graph #3. Illustrative evolution of capital savings and investments

Every stage of this hierarchy is associated with different risks, returns and wealth. At the bottom, we observe bank deposits as the least risky type of investment, with a lower yield. This stage is characterized with less personal wealth and most income is spent on essential consumption. The upper stages of the hierarchy are associated with higher risk and respectively higher yield as well.

While we know how the evolution of capital savings evolves in theory, what is happening in Georgian reality is interesting as well. Stable economic growth in the last several years has contributed to wealth accumulation among Georgians. Thus, total deposits by individuals increased by almost four times during the last seven years. It is difficult to say how equally these deposits are distributed, but it is a fact that more money has been saved. During this period, the demand on real estate increased as well. According to REMLab, the number of sales transactions in 2017 increased from 89.1K unit to 98.6K unit. The largest part of this growth was recorded in Tbilisi, but increased demand on real estate outside Tbilisi was also observed.

Positive trends in bank deposits, as well as in real estate, give us an indication that the first two stages of the capital saving hierarchy seem to be developed in Georgia. On the other hand, Georgia’s security market is relatively young. The corporate bond market is trying to catch up with the government bond market, which is relatively mature, but the process is proceeding at a slower pace. Specifically, in the last four years, outstanding corporate bonds more than quadrupled and reached GEL232 million. Nevertheless, the ratio of publicly issued corporate bonds to GDP is still low (0.6%).

WEF not only provides a hierarchy and stages of evolution of capital savings/investments, but also provides a recommendation on how to upgrade from the lower stages to the upper ones. The following factors are highlighted by WEF for capital market development: market participants (bond issuers, investors, and financial agents), market intermediaries, infrastructure providers, market regulation, and legislation. Moreover, migrating savings from traditional bank deposits and investment in real estate to more complex investment products requires educating the public on the benefits of long-term investments. Financial education can contribute much to this process.

In summary, while financial literacy is still low in Georgia and the capital market ecosystem is still under development, investing in real estate remains most popular and profitable investment option for the Georgian population.

REFERENCES:

Real Estate Market Highlights, http://iset-pi.ge/index.php/en/real-estate-prices-index/2189-real-estate-market-highlights-9-january-march-2018

Fixed Income Securities in Georgia, TBC Capital 2018, http://tbccapital.ge/en/research/reports/fixed-income-securities-georgia

Accelerating Emerging Capital Markets Development Corporate Bond Markets, http://www3.weforum.org/docs/WEF_Capital_Markets_Report_2015.pdf

Comments