World Cup 2018 is getting close and football can already be felt in the air. The squads are almost finalized, new jersies are already on sale, and fan clubs are preparing venues to watch football. These are all traditional preparation for the World Cup, but interestingly for me, and possibly for you as well, football has also affected education, specifically financial education. If you are intersted in how football and financial education are linked, Financial Football is the answer. To give you some background information before you test the game yourself, Financial Football is a project developed by VISA in more than 40 countries in the world. It is an interactive game that allows young people (but not only young people) to have fun and also test their financial knowledge. Last week VISA, in collaboration with National Bank of Georgia (NBG), launched the Georgian version of Financial Football. The launch event was opened with a panel discussion where the panelists highlighted the activities already implemented in Georgia to promote financial education. They also mentioned that to date, few financial education programs have been comprehensively assessed in terms of their effectiveness. This inspired me to start exploring the effectiveness of already-piloted financial education projects.

Let’s forget about Financial Football for a while, because it has just been launched and further reasearch cannot be done at this stage. But, thanks to National Bank of Georgia and the Ministry of Education and Science, we do have a financial education project called SchoolBank, which requires further elaboration.

SchoolBank is a project that was developed by Child and Youth Finance International (CYFI) and implemented by the NBG, in collaboration with the Ministry of Education and Science. The project aims at the economic empowerment of children and youth by providing them with access to appropriate banking products and economic citizenship education.

As emphasized in the National Strategy of Financial Education, the foundation of financial education should be built starting at a young age. At this early stage, it is easier to develop good personal finance management habits, and turn them into a culture. In the long run, by investing in youths’ financial education, it is possible for them to form useful attitudes and skills, which they will need to make better financial decisions. The positive effect of financial literacy program in Japanese schools, for instance, is summarized by Sekita (2011). He finds that if people save regularly when they are children, they are more likely to develop a plan for retirement when they become adults.

SchoolBank was piloted in 11 public schools in Tbilisi, Rustavi and Mtsketa for 3 months, starting last October and running until December 2017. The piloted SchoolBank project was mostly concentrated on a teaching component. The teaching module contains 15 topics related to personal finance, consumer rights and responsibilities, and topics related to the banking sector in general.

To evaluate the effectiveness of SchoolBank project, a pre- and post- program questionaire was used. The standard methodology to measure the level of financial literacy is to count the number of correct answers to the financial literacy questions (Hung et al. (2009), Kalwij et al. (2017)). Similarly, in this case, financial literacy has been calculated as the number of correct answers to six of the financial literacy questions.

Q1. Attitude: I think that saving is useful;

Q2. Behavior: I regularly save money in a safe place;

Q3. Behavior: I always plan how to spend money;

Q4. Education: I know what the main financial terms, deposits and payment cards mean

Q5. Education: Suppose 10 children are given 250 Gel and 50 tetri If this money should be distributed equally, how much money each child will get?

Q6. Education: Suppose you make a 100 GEL deposit and the annual interest rate on deposit is 2%. How much money will you accumulate after 5th year?

Q1-Q4 are Likert scale questions (a scale used to represent people's attitudes to a topic), starting from “strongly disagree” to “strongly agree.” Answers such as “agree” and “strongly agree” are treated as “correct,” while “strongly disagree,” “disagree,” and “neutral” are treated as “incorrect.” Q1-Q6 cover all three components of financial literacy, such as financial attitudes, financial behavior and financial education.

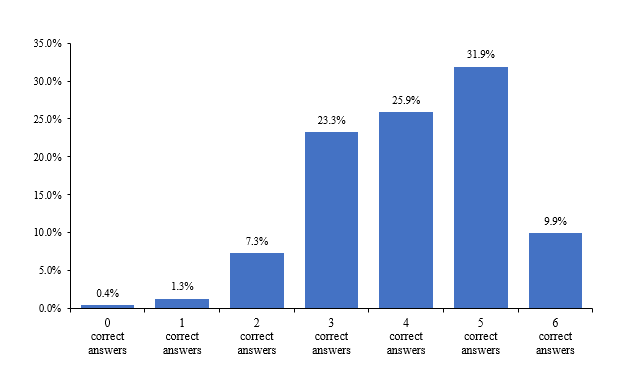

Graph #1. The distribution of correct answers for the pre-test (number of respondents - 232)

The distribution of financial literacy based on the pre-test results shows that the most of the students answered the majority of questions correctly. The distribution is left-skewed and there was only 1 student who answered all questions incorrectly. On average, 68% of the questions were answered correctly, which amounts to four questions out of six.

The data does not give the opportunity to use more sophisticated methods; instead, we focus on mean comparisons to evaluate the effectiveness of the SchoolBank project. It should also be kept in mind that the number of responses for pre- and post-tests are not the same. This means that 232 students started SchoolBank classes but only 161 finished it. The exact reasons for the drop-outs are not known, but it might affect the interpetation of the results. As we mentioned above, we measured the financial literacy before and after SchoolBank project for different sub-groups. On average, the level of financial literacy increased significantly, meaning that after the SchoolBank project, students answered 77% of financial literacy questions correctly, while the same indicator was 68% before the SchoolBank project. The study shows that such improvement of financial literacy is mostly driven by a significant increase of financial knowledge and attitudes, with the effect on financial behavior (answers to the following questions: I regularly save money in a safe place and I always plan how to spend money) being very limited. These results are consistent with existing studies (Batty et al. (2015), Kalwij et al. (2017)) which conclude that in the short term, financial education programs contribute to financial knowledge and attitude, but need time to transmit financial skills to financial behavior.

Table 1. Pre and post financial literacy (% of correct answers) by different sub-group

| Avarage | Boys | Girls | Capital city | Other cities | 7th grade | 8th grade | Has deposits | Does not have deposits | Number of observations | |

| Pre | 68% | 68% | 68% | 71% | 65% | 69% | 67% | 76% | 67% | 232 |

| Post | 77% | 77% | 76% | 84% | 71% | 80% | 74% | 77% | 77% | 161 |

| Difference (Percentage Points) | 9%*** | 9%*** | 8%*** | 13%*** | 6%** | 11%*** | 7%** | 1% | 10%*** |

*** significant at 1% level, ** significant at 5% level, * significant at 10% level

Source: Author’s own calculation

Boys and girls recorded very similar financial literacy levels before and after SchoolBank project. This is intriguing, but because of the self-selected sample, we can’t conclude that in general boys and girls have similar literacy levels and that no gender inequality exists. The result might be driven by the methodology of the sample selection. SchoolBank is not a mandatory course, and only children who are interested in the topic are enrolled. This means that, more or less, children with similar interests and similar initial financial literacy levels are selected. We observe a statistically significant improvement of financial literacy in both groups. Before Schoolbank, both girls and boys answered 68% of questions correctly but afterwards the share of correctly anwered questioned increased to 77%.

It is worth noting that before the SchoolBank project, the difference in financial literacy levels between Tbilisi’s schools and schools from other cities, such as Rustavi and Mtskheta, was six percentage points. After the course, we observe a significant improvment in financial literacy in both sub groups. Interestingly, on average, students from Tbilisi schools improved their financial literacy level (by 13 percentage points) more than the students outside Tbilisi (by 6 percentage points). Thus, the gap in financial literacy between Tbilisi schools and the schools outside Tbilisi increased significantly. The exact reasons behind this disparity can not be observed from the data, but further investigation is needed as to why the project was less effective outside Tbilisi - was it due to students, teachers, or other administrative or technical issues?

Due to the fact that SchoolBank was the first official financial literacy course tought at schools, we observe that the initial financial literacy for 7th and 8th grade students are very similar, in the 67-69% range. After the SchoolBank project, improvement in financial skills is observed to occur at a higher (by 11 percentage points) for 7th grade students than for 8th grade students (by 7 percentage points).

It is noteworthy that students who have a bank account, on average, answered 76% of financial literacy questions correctly in the pre-test, while the same indicator is only 67% for students who do not have a bank account. After the SchoolBank project, we observe almost no change in financial literacy level for account-holder students, but the improvement in financial literacy for students without a bank account is significant. Therefore, after SchoolBank, we observe a convergence of financial literacy levels between these two groups.

The positive interdependence between having a bank account and financial literacy is captured in our empirical model as well. Due to the lack of available data, we can’t conclude that there is a causal relationship between having a bank account and higher financial literacy. But students with bank accounts are more likely to be financially literate than those without. On the other hand, there might be some external factors which determine both children’s financial literacy and having a bank account. Existing literature mostly concentrates on economic socialization. Economic socialization is largely based on the role of the family in teaching children about money and personal finance (Lunt and Furnhain, 1996). The role of parents in this process is vital. Parents help children in opening savings accounts and teach them the importance of saving (Mandel, 2010; Kim et. al, 2011). From this viewpoint, children’s economic socialization is mostly affected by parents’ individual decision-making. This might be true for the Georgian case as well. Between the ages of 13 and 14, financial decisions such as opening a bank account are not made by children alone, but require the parents’ permission. So, having a bank account means that parents have decided to save money for their children. Thus, this decision is mostly driven by parents’ financial literacy, not the children’s financial literacy per se.

Despite direct knowledge transition from parent to children, existing literature highlights the role of early access to financial products for children’s financial literacy. Specifically, when children already have a bank deposit they receive benefits in terms of knowledge that they gain when visiting banks, depositing money in accounts, calculating their interest income, becoming familiar with the time value of money, etc. (Friedline et. al (2012)).

To sum up, the SchoolBank pilot project has already finished, and we see it has some interesting and action-provoking results in terms of improving financial literacy among school children. We hope new tool offered by VISA and National Bank of Georgia will further enhance the skills of our next generation to deal with personal finances.

So, while you are watching the World Cup, encourage your children to try out Financial Football. Unlike the World Cup, Financial Football does not have losers; everyone can score on their financial goals.

Reference:

- Batty, M., Collins, J. M., & Odders‐White. (2015). Experimental evidence on the effects of financial education on elementary school students' knowledge, behavior, and attitudes. Journal of Consumer Affairs, 49(1), 69-96.

- Friedline, T., Elliott, W., & Chowa, G. A. (2013). Testing an asset-building approach for young people: Early access to savings predicts later savings. Economics of Education Review, 33, 31-51.

- Hung, A., Parker, A. M., & Yoong, J. (2009). Defining and measuring financial literacy.

- Kalwij, A. S., Alessie, R., Dinkova, M., Schonewille, G., van der Schors, A., & van der Werf, M. (2017). The effects of financial education on financial literacy and savings behavior: Evidence from a controlled field experiment in Dutch primary schools. USE Discussion paper series, 17(05).

- Kim, J., LaTaillade, J., & Kim, H. (2011). Family processes and adolescents’ financial behaviors. Journal of family and economic issues, 32(4), 668-679.

- Lunt, P., & Furnham, A. (1996). Economic socialization. Edward Elgar Publishing.

- Sekita, S. (2011). Financial literacy and retirement planning in Japan. Journal of Pension Economics & Finance, 10(4), 637-656.

Comments