- Details

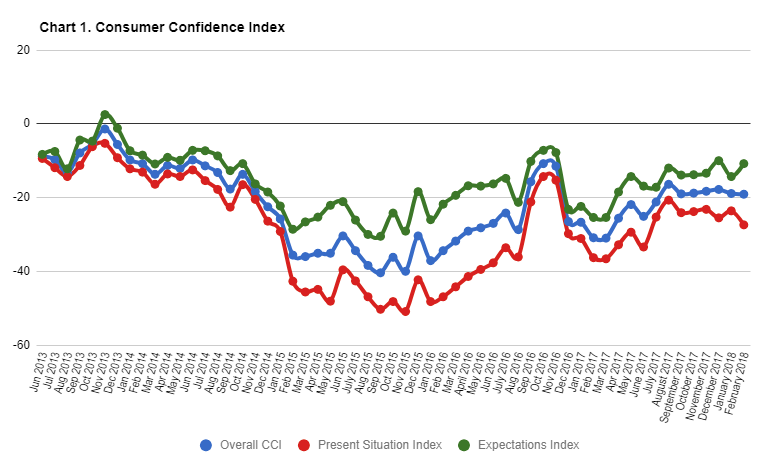

Georgian consumer sentiment remained practically unchanged in February 2018, extending a fairly long trend of stability (or stagnation) that goes back to at least August 2017. The CCI lost a tiny 0.2 index points, declining from -18.9 in January to -19.1 index points in February 2018. CCI’s two sub-indices, capturing consumer expectations and present situation assessment, moved in the opposite directions. The Present Situation Index lost 3.8 (declining from -23.6 to -27.4 index points). Its complement, the Expectations Index, added 3.5 points (rising from -14.3 to -10.8 index points). Georgians seem to remain optimistic even when lacking joy in their day-to-day existence.

- Details

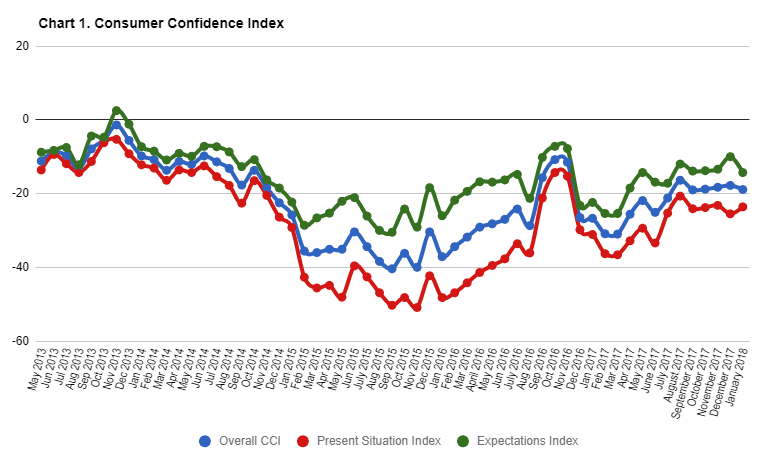

The second half of 2017 lacked any drama, at least as far as Georgian consumer confidence (CCI) is concerned. During this period, the CCI moved within a very narrow band of [-16; -20] index points, with monthly changes not exceeding one or two points. This trend continued in January 2018 – the CCI lost 1.1 index points, declining from -17.8 in December to -18.9 index points in January 2018. CCI’s two sub-indices, capturing consumer expectations and present situation assessment, moved in the opposite directions. The Present Situation Index climbed 1.9 to -23.6 index points; the Expectations Index, on the other hand, lost a more significant 4.3 index points to -14.3.

- Details

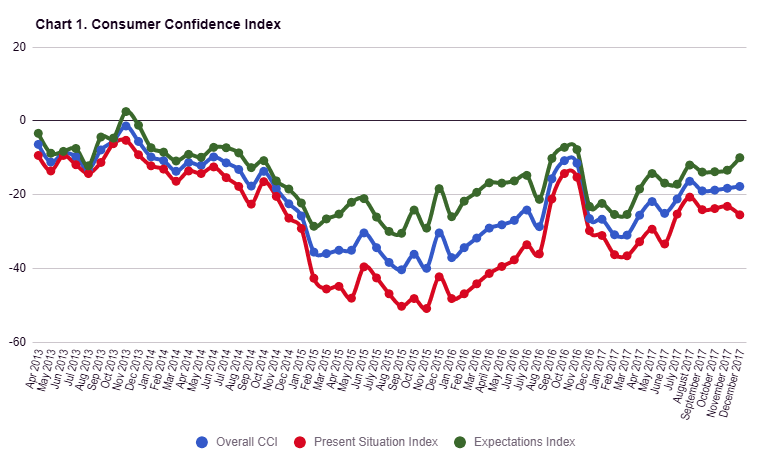

Georgian Consumer Confidence (CCI) continued to improve, albeit slightly, in December 2017. CCI added 0.5 index points over November 2017, and 8.7 index points y/y, that is compared to December 2016. Interestingly, people’s perceptions of the recent past and expectations diverged in December. CCI’s Present Situation sub-index went down by 2.3 points m/m, from -23.2 to -25.5), whereas the Expectations sub-index went up by 3.4 index points (from -13.4 to -10). However, both sub-indices ended the year ahead of their last year’s levels. The Present Situation sub-index demonstrated a rather modest improvement of only 4.3 index points (from -29.8 to -25.5). The Expectations sub-index added a very healthy 13.2 index points (from -23.2 to -10), betraying a sense of cautious optimism on the part of Georgian consumers.