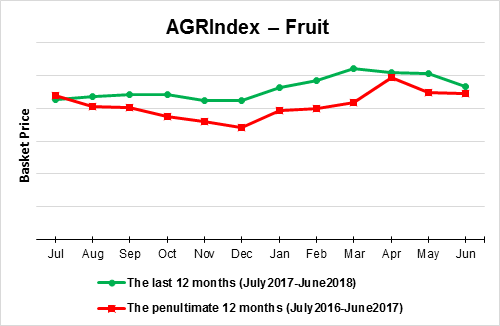

In June 2018, FRUIT prices continued their recent declining trend — the m/m change last month ...

Read more

ISET-PI has begun publication of a new product – the Budget Execution Monitor (BEM). The goal of the BEM is to forecast revenues and expenditures of the general government of Georgia for the cu...

Read more

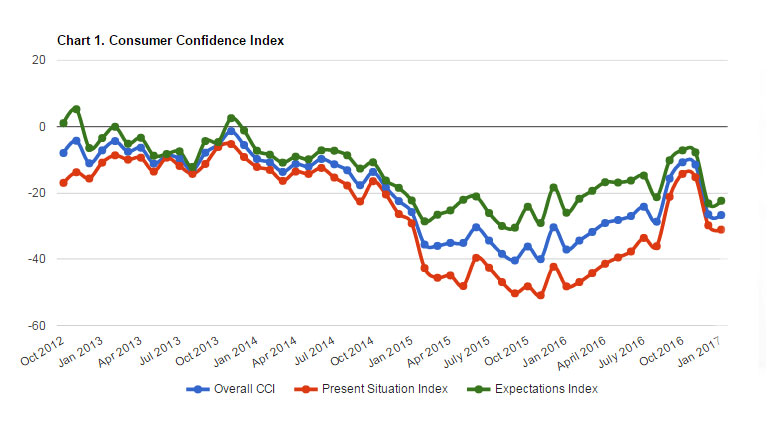

After a dramatic fall in December 2016, consumer confidence in Georgia stabilized at a low level. While in January, the present situation index was continuing to go down by 1.3 points from -29.8 to -31.1, peoples’ expectations have rebounded by 0.8 points from -23.2 to -22.4, so that the overall CCI of January remained almost unchanged (-26.7 points) compared to December (-26.5 points).

Unlike in December, however, exchange rate fluctuations did not have an identifiable impact on the index in January. During the week of the interviews, the Georgian lari moved in both directions: the lari appreciation that started in the end of December was succeeded by a depreciation a week later, and the change of tides took place while the interviews were conducted. One might say that the lari lost its momentum soon after all necessary dishes for the Georgian New Year supra had been bought.

There was a striking discrepancy between consumer confidence in Tbilisi and in the regions. The CCI went up from -24.6 to -20.8 (3.8 points) in Tbilisi while it continued to go down everywhere else in Georgia, where it reached -31.1 points. This led to an unprecedented gap between Tbilisi and the regions of 11.1 points.

Perhaps, the recently announced decision to cut the agricultural budget by 60 million lari contributed to these negative sentiments in Georgia’s rural areas. This, however, would presuppose a great amount of rationality and prognosis skills on part of Georgia’s rural population, coming close to the notorious notion of homo oeconomicus. As the homo oeconomicus was frequently shown to be rather a kind of caricature and not a realistic description of human behavior, maybe homo oeconomicus does not exist but Agricola oeconomica does?

It is also interesting that the gap between the perceptions of the present situation and future expectations is much wider in the regions than in the capital. In Tbilisi, the present situation and future expectation indices have been almost indistinguishable since October 2016. This is very different to the preceding 21 months (starting in January 2015), when the expectations were consistently much higher than the perceptions of the present situation. For the rural population, this discrepancy reaches even further back in history: there is not one single month since the beginning of the CCI in which the expectations were not higher than the present situation index.

At the surface, this finding challenges the controversial “rational expectations” paradigm, which drives the results of many economic theories, particularly in macroeconomics. The paradigm implies that expectations should not get consistently disappointed. People should learn from the fact that reality did not meet their expectations in the past and revise the ways in which they form their views about the future. In the long run average, expectations and real outcomes should match.

For a long time, Georgians got it consistently wrong, always expecting more from the future than what actually materialized. In the countryside, they have been doing this since the inception of the Georgian CCI, and in the last months were no signs that this will change. In Tbilisi, on the other hand, it looks as if people have finally corrected their hopeful expectations to realistic levels. Indeed, proponents of a weak form of the homo oeconomicus (or “rational man paradigm”, as it is sometimes called) often argue that in the long run, people are rational, while in the short run they may fall victim to all kind of biases. What we saw in October was possibly the “return to rationality” which took place in Tbilisi but has not occurred yet in the regions. At some point, everybody becomes realistic, but in the countryside, it takes a bit more time.

Indeed, we are not the first to relate CCI data with the rational expectations hypothesis. A master’s thesis submitted by Aino Silvo to the University of Helsinki tests whether CCI data support or reject the rational expectations hypothesis. While she comes to the result that the “permanent income rational expectations” hypothesis is not compatible with CCI data (we may discuss this hypothesis, which demands an even higher degree of rationality, in a future issue of the CCI), her findings seem to support the ordinary rational expectations paradigm.