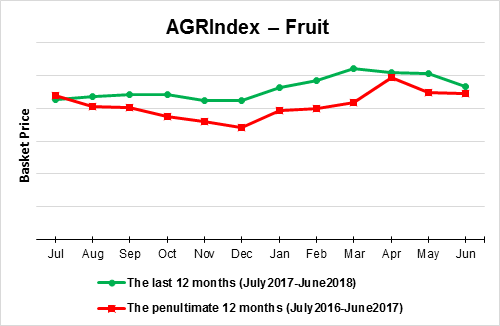

In June 2018, FRUIT prices continued their recent declining trend — the m/m change last month ...

Read more

ISET-PI has begun publication of a new product – the Budget Execution Monitor (BEM). The goal of the BEM is to forecast revenues and expenditures of the general government of Georgia for the cu...

Read more

According to the most recent statistics, the Georgian economy is showing signs stabilization in the last quarter of 2015. Economic growth increased to 3% year on year in October – about the same as the estimated average real GDP growth rate (2.8%) for the first ten months of 2015.

ISET-PI’s Leading Economic Indicators forecast still predicts 3.6% growth in the fourth quarter (the forecast remained virtually unchanged since last month’s update), and 2.9% annual GDP growth for 2015.

The Georgian economy is thus showing a degree of resilience to regional economic pressures.

According to recently released statistics, the Georgian economy continued on a stable trajectory of low- single digit growth in September and October. The rapid growth estimates for October show 3% GDP growth, definitely an improvement over the 2.2% growth in September. The estimated average real GDP growth rate in the first ten months of 2015 was 2.8% year on year.

The latest figures point to the strong possibility that Georgia will close out the year with annual real GDP growth above the 2% projected by IMF for 2015

In the third quarter of 2015, estimated real GDP growth reached 2.5% year on year. This was very close to ISET-PI’s third quarter forecast of 2.6%.

At the same time, ISET-PI’s Leading Economic Indicators forecast puts 2015 annual GDP growth at about 3%. Download the full report

According to Geostat’s rapid estimates, Georgia’s economy grew by 4.3% in March 2015. After the slowdown of the last several months, the growth rate in February and March looks very promising. In the first quarter of 2015, GDP growth amounted to 3.2%. In March, VAT payers’ turnover increased by 9.9% annually, and the total consumption of electricity increased by 6.2%. ISET’s GDP forecast for the second quarter of 2015 is even more optimistic, at 5.1%.

Despite the depreciation of the lari and pressure on inflationary expectations, annual CPI inflation reached just 2.5% in April. The increase in prices was driven to a large extent by food and non-alcoholic beverages (2.7%), healthcare (6.4%), alcoholic beverages and tobacco (11%). The prices of alcoholic beverages and tobacco rose because excise tax on some of the products included in this category was increased. Taken together, these three categories contributed over 2 percentage points to the CPI inflation rate.

After relatively high GDP growth in February and March, the Georgian economy slowed down considerably in April. According to Geostat’s rapid estimates, GDP grew by only 0.9% annually in the reporting month. Consequently, in the first four months of 2015 the Georgian economy expanded by 2.6%. ISET’s GDP forecast for the second quarter of 2015 is 5.1%, which seems to be rather overoptimistic given the grim start of the quarter.

The IMF’s estimated GDP growth for 2015 stands at about 2%; however, risks of downward pressure have recently increased. Moreover, the Business Confidence Index (BCI), ISET-PI’s quarterly publication reporting business’ expectations, hit its historical minimum in the second quarter of 2015. Meanwhile, the Consumer Confidence Index (CCI), another ISET-PI publication, has remained at its minimum level for four consecutive months.

After a dip in April the GDP growth rate seems to be back on track, the year-on-year growth rate in July was 7.2%. Higher rates of electricity consumption and increase in the change of VAT payers’ turnover corroborate this evidence. In July electricity consumption and VAT payers’ turnover were 3.8 and 15.4 percent higher compared to the same month in the previous year.

However, the optimistic growth data is not reflected in the consumer sentiment, as captured by the CCI index. In particular, after a slight increase between April and June this year, the CCI Present situation index fell in July and continued falling in August. Why are consumers not feeling the benefits of higher growth? One has to keep in mind that a significant share of population in Georgia is employed in agriculture (typically, subsistence farming), while the GDP growth is driven largely by trade and manufacturing sectors, which command a significant share of GDP - together about 40%, but a much lower share of the overall employment in the country. Therefore, the gains in these sectors are unlikely to be immediately reflected in the gains of self-employed rural population. Download the full report