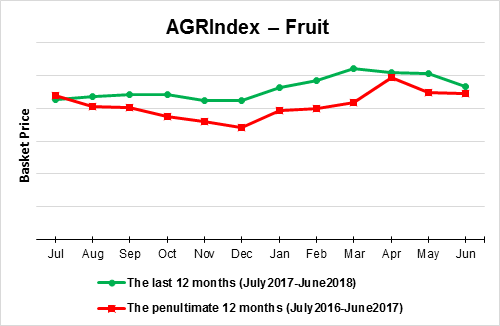

In June 2018, FRUIT prices continued their recent declining trend — the m/m change last month ...

Read more

ISET-PI has begun publication of a new product – the Budget Execution Monitor (BEM). The goal of the BEM is to forecast revenues and expenditures of the general government of Georgia for the cu...

Read more

After the sharp decline in Q2 2015, business confidence (BCI) in Georgia showed signs of rebounding in Q3. In line with expectations, April, May and June were ex-post not particularly favorable months for Georgian businesses.

Out of the 211 companies surveyed, about half reported having trouble in business activities in April, May and June (reflected in low sales, turnover or production numbers). Accordingly, the main driver of the overall BCI rebound in Q3 was the strident increase in expectations. The business expectations index increased by 30 index points in one quarter – a sharp rebound that almost compensated for the loss of confidence in Q2 2015.

After being steadily optimistic for most of 2014 and in the first quarter of 2015, Georgia’s business confidence dropped by 24.5 points to an all-time low level of 3.6 on a scale of [-100; 100] points. The survey, which included 168 firms, suggests that business confidence declined on all measures, across all sectors, and for all firm sizes. Moreover, it is reflected in business perceptions concerning both current performance and expectations concerning the future.

The sharp decline in business confidence appears to be related to the recent depreciation of the Georgian lari and the political wrangling that followed. The drop in business confidence comes after seven months during which Georgian consumer confidence has been steadily declining, affecting consumer demand and sales.

While the retail sector was the first one to be affected by the slump in demand, second quarter data suggest that the Georgian financial sector is also starting to feel the heat. Financial sector confidence dropped by a record 50.8 points (from 50.9 index points in the first quarter of 2015 to merely 0.1 points in the second quarter)!

In the fourth quarter of 2014, the Business Confidence Index decreased and registered 24.9 on a scale of 100 points. This is down from the 40.4 recorded in the third quarter of the same year. The positive number indicates that the confidence factor among businesses is about 25 index points more positive than negative or neutral (e.g. a confidence index of 100 would have indicated that all firms in the sample reported a positive outlook. An index of zero would indicate that the weighted balance of positive and negative views reported by firms is about equal or, alternatively, that all firms reported no change in the current business situation. For more details, see the methodological notes). The reduction in the confidence index was driven by large firms in almost all sectors. At the same time, we note that SME business sentiment continues to grow.

The Business Confidence Index decreased slightly and registered 24.5 points in Q1 (previous quarter BCI was 24.9). Decrease in the retail sector business confidence is marginally the highest. This is driven by a sizeable drop in Consumer Confidence. Consumer Confidence Index (CCI) fell sharply since November 2014. The sales price expectations turned from negative to positive in the first quarter of 2015. Insufficient demand remains the most limiting factor for doing business in Georgia.

In the second quarter of this year, the ISET Business Confidence Index registered 21.7 on a scale of 100 points (see methodology below). This is down from the 30.2 recorded in the first quarter of the same year. The positive number nevertheless indicates that confidence factor among businesses is about 21.7 more positive, rather than negative or neutral (e.g. a confidence index of 100 would have indicated that all firms in the sample reported a positive outlook. An index of zero would indicate that the weighted balance of positive and negative views reported by firms is about equal, or alternatively that all firms reported no change in the current business situation). Download the full report