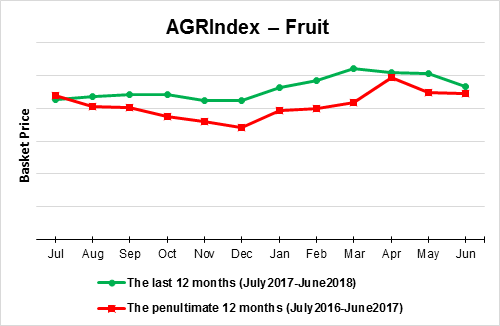

In June 2018, FRUIT prices continued their recent declining trend — the m/m change last month ...

Read more

ISET-PI has begun publication of a new product – the Budget Execution Monitor (BEM). The goal of the BEM is to forecast revenues and expenditures of the general government of Georgia for the cu...

Read more

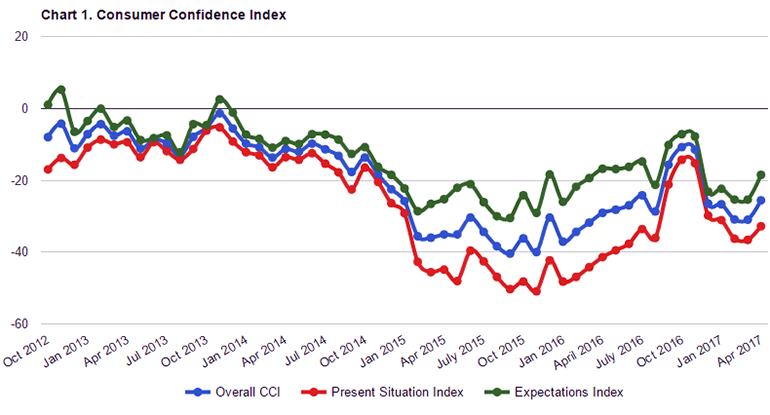

In April, the CCI went up by 5.4 points (from -31 to -25.6). We believe that two factors stimulate the raised consumption mood of Georgians: firstly, the new opportunity to travel visa-free to the countries of the European Union; secondly, the stabilization of the lari exchange rate.

While the visa liberalization is an entirely new development, a close connection between the value of the lari and consumption sentiments of Georgians could already be observed in the past. Many Georgians are deeply pessimistic about the stability of their currency in the long-term, which is demonstrated most strikingly by the high and persistent level of dollarization. Therefore, when the lari started to depreciate in the autumn of last year, many Georgians were not overly surprised and expected this to be a trend that would continue throughout the year 2017. Yet, in March and April, the lari stabilized, proving the pessimists wrong! The April upturn of the CCI may therefore be fueled by an element of positive surprise (something not occurring too often in the Georgian economy).

In economics, the non-realization of negative expectations works in the very same way as the materialization of positive expectations. For example, the German Deutsche Bank resorted to various questionable practices during the financial crisis of 2008, resulting in the staggering number of 7800 lawsuits worldwide, threatening the very existence of Germany’s largest bank. When a few months ago, it turned out that in the wake of one of these lawsuits, Deutsche Bank has to pay a fine of 7.2 billion dollars, this resulted in an immediate price jump of 4.5%. Why? Investors had expected the fine to be as high as 14 billion dollars. Given these expectations, paying 7.2 billion was really good news!

This “doomsday delayed” phenomenon we may also see in the Georgian CCI of April.

By examining the results for Tbilisi and the Rest of Georgia, we see that non-Tbilisians are affected more strongly by the April upturn than Tbilisians. The CCI went up from -25.3 to -23.4 (mere 1.9 points) for Tbilisi but from -34.7 to -27.3 (amazing 7.4 points) for the rest of Georgia. More so than Tbilisi, where some self-propelled economic dynamics take place, rural Georgia depends heavily on remittances. How does this relate to the visa liberalization? Well, the visa-free regime allows to enter the European Union for 90 days within a 180-day period, for business, tourist, or family purposes – but not for work. Yet, could it be that some people hope to find illicit employment? While we do not know, it is clear that in those jobs where Georgians often work abroad, namely housework and nursing, the rate of illicit employment is extremely high in Europe.

The upswing hits the old and less qualified stronger than the young and highly qualified! The CCI for young Georgians went up from -27 to -22.2 (by 4.8 points) but for the elderly from -32.9 to -27.4 (by 5.5 points). Likewise, the CCI for highly educated Georgians went up from -24.9 to -21.5 (by 3.4 points) but for the less qualified from -40.4 to -34.7 (by 5.7 points).

While for highly qualified young Georgians, it has already been possible to travel to the European Union, for older and less qualified people the visa liberalization opens up entirely new opportunities. For the former, submitting the necessary documents (including hotel reservation, return flight ticket, proof of employment, and bank account statement) was a nuisance but not an unsurmountable obstacle. Yet, for most less qualified and elderly persons without high-paying jobs, spending time in Europe was but an impossibility.

Therefore, it is not surprising that economically weaker groups react more enthusiastically to the lift of visa barriers, and this is reflected in the CCI data.