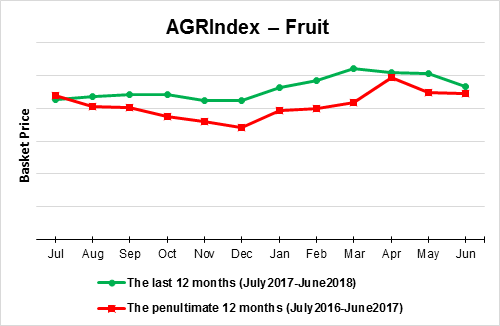

In June 2018, FRUIT prices continued their recent declining trend — the m/m change last month ...

Read more

ISET-PI has begun publication of a new product – the Budget Execution Monitor (BEM). The goal of the BEM is to forecast revenues and expenditures of the general government of Georgia for the cu...

Read more

After the sharp fall in consumer confidence that occurred in December 2016, the index continues in a mostly horizontal direction with a minor but still noticeable negative trend. March 2017, with a minor decrease by 0.1 points, very much fits in this story of a “slow death of the Georgian economy”. The present situation index decreased by 0.3 points, albeit much less than in the previous months, while the expectations index has stayed literally the same (-25.4 points). Maybe this indicates a stabilization (though at a low level) or even heralds a turnaround?

The less positively inclined will remark that the end of winter blues did not have any effect on the economic outlooks of Georgian consumers. And they will point out that the positive news about GDP growth, which were announced at the end of February, did not have any visible impact on consumer confidence. According to Geostat’s preliminary estimates, real GDP in January and February increased by 5.2% and 4.4% compared to the same months of the last year, respectively. While this were significant gains compared to the previous months (in December and November growth rates only reached 0.3% and 2%, respectively), this encouraging year-on-year development was not echoed in consumer confidence: overall CCI declined considerably in February and March in year-on-year terms. Georgia seems to have slid into a severe economic depression.

On the other hand, perhaps there is a cognitive bias at play. Maybe, individuals do not react as strongly to positive economic developments as to negative ones? Considerable empirical evidence has been accumulated supporting the hypothesis that people do not react symmetrically to positive and negative economic changes, e.g., Laur (1985), Clagett (1986), and Holbrook et al. (2001). These empirical investigations were inspired by Prospect Theory, developed in Kahneman and Tversky (1979), which triggered revolutionary developments in economics thought in the second half of the 20th century ad today is the main competitor to traditional rational choice theory. According to Prospect Theory, individuals are more strongly affected by personal losses than by personal gains of the same magnitude, an assumption termed “loss aversion” by Kahneman and Tversky. Indeed, in Prospect Theory, this is merely an assumption, though one that allows for a theory that is capable of explaining human behavior in a variety of situations where classical decision theory fails.

In a similar vein, also backed by academic literature, the optimists may argue that media have the potential of further exacerbating negative attitudes in a population, which may play out in consumer confidence, too. Shleifer (2005) and Shapiro (2010) have found evidence for the U.S. that media focuses more on conveying negative information, as this attracts more attention of readers and viewers. Saying that something is deteriorating or worsening appeals to the deeply-rooted “alarm” instinct of humans, which increased survival probability in ancient times. In many cases, it is not dangerous to ignore positive news, but it is often fatal to disregard negative information. If the information that the bear is not strolling anymore in front of the cave is ignored, the caveman will be unnecessarily careful when going out, which is not a great disadvantage. Yet, if the information that the bear is still strolling in front of the cave is ignored, this may turn out deadly. Media, having financial incentives to report what attracts more attention, will therefore be biased towards the negative.

Therefore, we can speculate that positive news about GDP growth rates did not improve consumer confidence because media did not report it prominently or consumers themselves perceived and memorized news asymmetrically because of their negativity biases.

The diverging confidence in Tbilisi and in the regions remains an issue also in March 2017. In Tbilisi, overall CCI saw a slight improvement from -25.9 to -25.3 (0.6 points). As for the rural areas, the index went up from -35.4 to -34.7 by 0.7 points. However, the gap between Tbilisi and rural areas remains almost the same as it was in February 2017.

As can be seen from the chart above, the gap between Tbilisi and the rest of Georgia is mostly due to perceptions of the present situation. More precisely, consumers from Tbilisi are much more positive when it comes to change in personal financial position, current ability to save both in personal and general terms, and the current ability to make major purchases.

| ; | |